Why are investment firms willing to play this game?

Because since the mid-1970s, subprime loans have never had any problems, and the profits have been quite good; after 20 or 30 years of operation, everyone thought the profits would continue.

Why does the outspoken Mark say the entire financial market is a scam?

In the beginning, the bonds packaged by the loans were basically very good - the loan applicants would basically repay the loan on time, and at that time the paper was wrapped in gold; however, there were always creditworthy lenders and some who did not. credit lender. Gold-covered paper bonds made up of trustworthy people can sell for a good price, but no one will buy a bond rated B—. The solution to this problem is to beautify it as "90% of the packaged bonds we sell are credit rated." made up for AAA loans" such a lie.

How did One-Eyed Bell discover the problem?

The down payment on a house is set at 5 per cent for the first two years, which is a temptation for more people to take out loans to buy houses so banks can pack them up for sale. So a stripper can own 6 houses. One-eyed Bell figured out that the big outage will come in June 2007, when people will know that subprime loans are just a piece of shit wrapped in paper.

What the hell is going on with the pressure a few people are under in the middle of the film?

Originally, according to estimates, the big outage should have occurred in June 2007 - this time is when a few people should be profitable - but the price of subordinate securities in the hands of investment companies did not fall but rose - this It means that a few people need to continue to pay the monthly gambling fee to keep the game going.

How did such a ridiculous situation happen?

Remember that who's brother's ex-girlfriend? She used to be with the Securities and Exchange Commission and is now going to join Goldman Sachs, which she previously oversaw; remember the old lady in S&P with sunglasses? The rating agency she works for gives AAA credit to anyone who pays them.

No one will buy a questionable packaged bond, and in order to continue to sell, the only way is to prove that the packaged bond is ok, "Look, its price is still going up!" Can there be a high year-end bonus?

The profit model that caused the financial crisis was this: Some people who wanted loans but couldn't repay them got their loans in various ways, and the banks that took those loans could get from those loans, for example , a total of 5% of the income, they package these loans of different quality and sell them to investors who need stable income, these investors can get, for example, 3% of the income, and then the investors sell again, take the offer People are sold again, and the whole world's economy is involved. Are those who take over the order stupid? Actually not. Because every time you sell, the seller will give a persuasive guarantee: the rating, the government guarantee, the largest insurance company in the United States, AIG, is willing to guarantee... Of course the seller knows that they are selling paper shit, but they don't care. , because they know that the whole world is involved, and that ultimately the government will use taxpayers' money to make up for it...

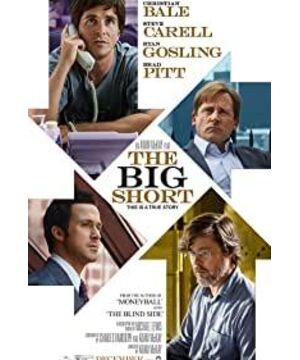

View more about The Big Short reviews