Introduction:

Buffett was a baseball player for a while when he was young! This is the pride of the elderly, and it is frequently used to show!

Today we also talk about American professional baseball, and it is closely related to investment!

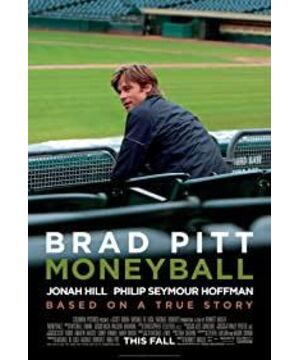

This film:

What is the purpose of a major league baseball team? Be the champion and win!

So how can this goal be achieved? Run the bases!

So how can you score and score again? Count on star players!

This is the popular team management concept, but also the traditional model!

However, the fat XX in the film tells us that as a professional player appraiser graduated from Yale, the above argument is primitive!

Victory depends on scoring, scoring depends on the team, not a certain star!

Take these sets for investment!

What is the purpose of investing? Gain profits and gain wealth!

So how can this goal be achieved? Accumulate compound interest!

So how can you accumulate and then accumulate this compound interest? Relying on trades and trades, doubling profits on a certain stock?

Obviously, mastering bull stocks, this fixed mindset is also the traditional thinking of investors, which belongs to a fixed pattern!

Abandon this kind of deep imprint, look again, what does cumulative compound interest rely on? The establishment of the value model!

One that is in line with the current situation, suitable for the market, self-renewal, and continuous error correction---investor's personal value construction!

This is the root!

Therefore, the protagonist in the film, Billy (Brad Pitt), the general manager of the California Oakland Athletics, bought the Yale economic professional player evaluator as an assistant.

He's going to start creating his own valuation system in order to build a scoring team, instead of shopping around for big stars (Are today's top stocks all future stars?)

The appraiser uses the baseball statistical data analysis method "Sabermetrics" to start from the actual win-loss ratio of the major leagues and the score and loss data required to obtain the win-loss ratio, and compile a large code to assist in the optimization of the balance formula and the composition selection. Frame!

Finally, from the 20,000 optional players, select 25 suitable candidates!

There are many players who are underestimated in baseball! (Companies undervalued by the market)

The first one:

Jeremy, a problem player, drug addict, clubbing, etc., but his salary is only $285,000;

------ Major shareholder reduction, layoffs, and media leaks , but the P/X is very low, the profit is stable, and the product sales in the real market continue to boom!

The second:

David, an older player, a star for 10 years, poor running, but low salary;

------Main board cyclical stocks, there was a bullish period 10 years ago, long-term bottom sideways, but reorganization After cultivating a segmented market, we have firmly controlled the upstream and downstream, and we are waiting for the opportunity to increase the price!

The third:

Scott, an old player, has an old elbow injury, has been in more than half of the major league teams, can't pitch, can't defend the base, but the salary is low;

------ 600 or 000 queue company, once It has a history of operational failure, has been reorganized or acquired many times, and has poor historical financial reports.

The above three players are brought into the field of vision, and the only feature is "high on-base rate"----more than 36%!

However, the club's professional scouts objected, because they have 30 years of experience in baseball, they have a sharp self-awareness, they have a wealth of judgment!

------ Therefore, they can report more than 2,000 A-share codes, and they can "consciously" feel whether a company is good or bad in 1 minute, and they can open the K line and immediately judge the next second. Minute by minute, the chart will go up or down, or even stop abruptly at that point!

Do you think we should listen to the scouts?

Don't jump to conclusions, because the 2002 new season started, in the initial 17 league games, the Oakland Athletics actually lost 14 games!

The media started laughing easily that baseball is played by people, not by numbers! The club should consider changing the general manager!

------Oh! Luck, remember that investing is also a matter of luck! Just imagine, if after 17 games, the club's board of directors decides to dismiss the general manager, would there still be a "Moneyball" thing?

Everything is gone! Of course, we don't have to worry about seeing this scene today, otherwise how could this story unfold!

What about beyond the story?

The value system you constructed has selected a certain "player" for you, but he will not increase for three years, how about you? Pick up a bat and threaten it?

What if it doesn't go up for five years? What if it doesn't go up in ten years? Maybe the bat picked you up and threatened it!

Won't it happen? Karaman said: The success rate of 50% is super high! How to endure and digest the failure with more than half of the remaining probability? Diversification theory? Basket of eggs?

How?

Swap? Oh! Does the protagonist Billy do the same? He returned to the traditional player allocation method and began to "sell high and buy low"? Do not!

He sold a few star stocks, and then went deep into the remaining target companies to stimulate the "confidence" of the management and encourage them to create "performance"!

finally! 7 straight wins!

This result allows the general manager to purchase slightly higher-quality players! In order to continue to promote the overall fund, the performance level rises steadily!

However, investors should not forget that at the 90th minute of the film, Billy and the fat assistant made a phone call. They tried their best to confuse the audience, lobby left and right, and make quick judgments. Finally, they messed up the expectations of other investors in the market. The Athletic's bargain buys just the player it needs: Rincon!

Then came an astonishing 9-game winning streak, a surprising 12-game winning streak, and an all-time record 17-game winning streak!

Finally, under his pioneering management methods, the heavily financially disadvantaged Oakland A’s ($41 million, with a win rate of $260,000 per game, and the New York Yankees, worth hundreds of millions, with a win rate of $140,000 per game) $10,000) in the 2002 season set an all-time record of 20 consecutive wins in the MLB, which is a miracle.

Of course, good luck does not have to be forever, and statistics are not God! The Oakland Athletics of California failed to reach the championship podium in the end!

However, the use of baseball statistical data analysis method "cybermetrics" became a new weapon in the baseball world, and everyone began to fight, first of all, the Boston Red Sox!

And Billy, who pioneered the application of this law, did not get out of the shadow of his personal history in the end. He gave up his high salary of 12.5 million US dollars and continued to stay on the original team, trying to use limited funds to play a huge professional baseball game!

The Red Sox, without losing their chance, under the personal leadership of Boss, adopted Billy's method and finally won the championship after 2 years!

The world is changing every day, always sit still and reflect on whether the wind is moving or the flag is moving, maybe the flagpole is moving!

At the end, my dear investor, can your personal value structure be able to "self-renew and correct mistakes"? You must know that there are more and more opponents who master the statistical data analysis method "Cybermetrics"!

Good luck is also away, you need new energy beans!

View more about Moneyball reviews