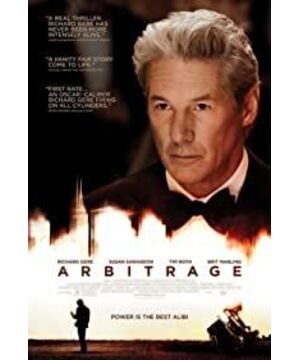

View more about Arbitrage reviews

I analyze the 400 million US dollars from the perspective of arbitrage trading

Thaddeus 2021-12-26 08:01:25

-

[last lines]

Brooke Miller: And to receive this prestigious award, I invite now to the stage the man who led this generous effort. And whose financial trading firm, Miller Capital, was just this morning acquired by Standard Bank and Trust. A dedicated businessman, a family man, philanthropist, and all-around humanitarian. A man I am very lucky to call my mentor, my friend, and my father. Mr. Robert Miller...

[standing applause]

-

Det. Michael Bryer: [talking on the phone] Yeah... I need a serious fucking favor.

More reviews

-

You may be disdainful of your sincerity

-

Let the hypocritical go to hell

-

6.9 points? I think it's only 5.0.

-

Feeling about the middle-aged crisis, I made a short film about what I wanted to say, and I would like to exchange ideas.

-

I analyze the $400 million problem in the film from the point of view of arbitrage trading