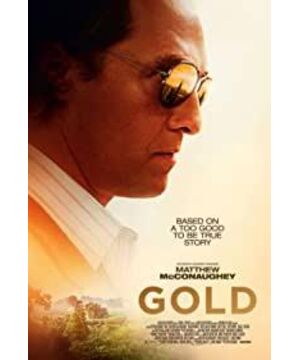

A third generation of mines on the verge of bankruptcy and a discredited geologist, eager to prove themselves, came to the jungles of Indonesia to find gold mines, but the end of the story became the fraud of the century. Those who are fortunate enough to experience the financial crisis in 2008 should know that it was an era when asset bubbles were flying all over the sky. The prices of various rare metals, oil, and bulk commodities kept refreshing your cognition, and even started to hype grain, garlic, mung bean, pepper… ...God wants to destroy him, he must first make him mad! The investment in mining rights is large, the time is long, there are many unpredictable factors, and the risks are extremely high. Just like the third generation of the mine took over a mining company that has grown and grown, but because it has not been able to find a mine, it is on the verge of bankruptcy. If you are fortunate enough to find a good mine, you will gain both fame and fortune, and a mining right can be listed on financing and the stock price will soar all the way. This film is based on real events. According to online information, Bre-X Mining Co., Ltd. is a small mining company located in Cagley, Alberta, Canada. Sang area implemented a joint venture gold exploration project, believing that it is an area with great potential for gold resources, Bre-X Company acquired the mining rights of "Busang Gold Mine" of BlackRock Company in Kalimantan Province, Indonesia, and then continued to The "good news" about prospecting for the project came as the company's shares traded on the Toronto Stock Exchange at C$0.45 per share.

In October 1995, 5 million ounces of discovered resources (about 160 tons) were announced, and by the end of 1996, 71 million ounces of discovered resources (about 2,270 tons) were announced. After a series of explorations, by March 1997, the gold reserves of the mine announced by Bre-X were between 2,200 and 6,200 tons. So far, the "Busang Gold Mine" has become the gold deposit with the most resources in the world at that time. After being put into operation, it can produce 84 tons of gold per year. Lehman Brothers called this discovery "the gold discovery of the century." The endorsement of the investment bank's predators made Bre-X's share price soar rapidly. From 0.5 Canadian dollars per share before the first announcement of the discovered resources in October 1995, to August 1996, Bre-X's stock skyrocketed. At 250 Canadian dollars per share, it has risen about 500 times in just 10 months. This is absolutely a crazy number. Crazy public investors, institutional investors, and all kinds of capital tycoons are all in a carnival. The company's highest market value once reached 30 billion Canadian dollars. The rising share price left few investors and mining experts in Canada, the U.S. and Indonesia wondering whether Bre-X had actually found the world's largest gold mine to date in Busan. Not only that, in order to compete for control of the gold mine, capital predators, mining giants, and politicians are all involved, and all parties have tried their best to gain control of Bre-X. However, after the large mining company - Freeport Company obtained the mining rights of the "Busan Gold Mine", it first verified the data of Bre-X Company, and randomly selected 4 drilling holes for verification. At a distance of 1.5 meters from the original hole position, Repeat drilling. Under highly confidential measures, it was sent to three authoritative commercial laboratories for analysis at the same time. Before the opening of the market on March 27, 1997, Freeport Company announced the verification results. The average grade of the original ore body was 0.06 g/ton. As soon as the market opened, the stock of Bre-X Company fell by 83%. The panic selling caused The stock market is closed. Later, Bre-X's stock continued at 2-3 Canadian dollars per share, stable for 40 days. Because some naive mineral exploration investors believe that even without 71 million ounces of gold resources, a tenth is worth investing in. However, the news on May 7 announced that the exploration of the "Busang Gold Mine" was all false information, and the "Busang Gold Mine" did not exist at all. Shares of Bre-X, Inc., by 3. C$12/share fell to C$0.03/share. This junior exploration company with a market value of 6.8 billion Canadian dollars (about 47 billion yuan) suddenly disappeared from the world. (So don’t have any hope for companies that make financial fraud, performance fraud, stories and dreams…) In fact, some experts have already spotted the flaws at first, because the corners of the gold in the test samples are round, which should be Hejin, and The gold dug out of the ground should have edges and corners, so this situation can generally be considered as gold. In the face of the test report full of loopholes, no one cares what the truth is, and people are willing to believe in the existence of gold mines, just because of this Gold mines can bring money. JP Morgan and other major capitalists, heroes from all walks of life in the mining industry, including the Indonesian government all want a piece of the pie. No one wants the gold to be fake. Everyone is making money and hi! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! CAD 03/share. This junior exploration company with a market value of 6.8 billion Canadian dollars (about 47 billion yuan) suddenly disappeared from the world. (So don’t have any hope for companies that make financial fraud, performance fraud, stories and dreams…) In fact, some experts have already spotted the flaws at first, because the corners of the gold in the test samples are round, which should be Hejin, and The gold dug out of the ground should have edges and corners, so this situation can generally be considered as gold. In the face of the test report full of loopholes, no one cares what the truth is, and people are willing to believe in the existence of gold mines, just because of this Gold mines can bring money. JP Morgan and other major capitalists, heroes from all walks of life in the mining industry, including the Indonesian government all want a piece of the pie. No one wants the gold to be fake. Everyone is making money and hi! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! CAD 03/share. This junior exploration company with a market value of 6.8 billion Canadian dollars (about 47 billion yuan) suddenly disappeared from the world. (So don’t have any hope for companies that make financial fraud, performance fraud, stories and dreams…) In fact, some experts have already spotted the flaws at first, because the corners of the gold in the test samples are round, which should be Hejin, and The gold dug out of the ground should have edges and corners, so this situation can generally be considered as gold. In the face of the test report full of loopholes, no one cares what the truth is, and people are willing to believe in the existence of gold mines, just because of this Gold mines can bring money. JP Morgan and other major capitalists, heroes from all walks of life in the mining industry, including the Indonesian government all want a piece of the pie. No one wants the gold to be fake. Everyone is making money and hi! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! In fact, some experts have already spotted the flaws at first, because the corners of the gold in the test samples are round, which should be river gold, and the gold dug out from the ground should have edges and corners, so this situation can generally be considered as gold. , In the face of the flawed test report, no one cares what the truth is. People are willing to believe in the existence of gold mines, just because this gold mine can bring money. JP Morgan and other big capitalists, heroes from all walks of life in the mining industry, including the Indonesian government Everyone wants a piece of the pie, no one wants the gold to be fake, everyone is making money and hi! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! In fact, some experts have already spotted the flaws at first, because the corners of the gold in the test samples are round, which should be river gold, and the gold dug out from the ground should have edges and corners, so this situation can generally be considered as gold. , In the face of the flawed test report, no one cares what the truth is. People are willing to believe in the existence of gold mines, just because this gold mine can bring money. JP Morgan and other big capitalists, heroes from all walks of life in the mining industry, including the Indonesian government Everyone wants a piece of the pie, no one wants the gold to be fake, everyone is making money and hi! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! Morgan and other major capitalists, heroes from all walks of life in the mining industry, and the Indonesian government all want a piece of the pie. No one wants the gold to be fake. Everyone is making money and hi! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! Morgan and other major capitalists, heroes from all walks of life in the mining industry, and the Indonesian government all want a piece of the pie. No one wants the gold to be fake. Everyone is making money and hi! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die! In reality, no one is asking about the reliability of Bre-X's gold exploration report, but rather the stock price. Those who buy stocks include some ordinary citizens. Maybe they have no professional knowledge. Listening to the wind is the rain. There is a kind of herd mentality. Watching the soaring stock price, they firmly believe that the stock will only rise and not fall. In the end, most of them lost their money. . What is more worth thinking about is that some institutional investors, including investment banks and mining elites, are backed by a strong professional team, including legal, financial and technical. The company's share price, participating in the competition for the control of the company, the competition is fierce and unprecedented, and the wide range of personnel involved is also rare. Maybe some people know it's a scam, but they don't tell the truth. Because of greed and luck, they continue to play this game of drumming and passing flowers. Just like during the subprime mortgage crisis, people didn't care about whether the house was occupied or not. During the tulip boom, people didn't care about the practical value of flowers. When everyone is making money, cold water is not welcome. Capital is profit-seeking, no one cares about authenticity, only how money makes money, especially quick money makes money. Lies will eventually become a piece of chicken feathers, no doubt, but the gamblers who participate in the game believe in only persisting until someone takes over! In the domestic capital market, such scams have emerged one after another in recent years, and many new scams are really surprising, but the essence is a trick of changing the soup without changing the medicine. History is repeating itself, and the scam continues. Cut again and again, live and die!

View more about Gold reviews