In times of national calamity, the government, financial groups, and the general public are all in the midst of a whirlpool. However, in the face of disasters, institutions or individuals of different sizes and capitals, before this unprecedented financial tsunami, had a completely different order of evacuation, and the foreign aid they could win was also different, so the results were naturally distinct.

In economics, "too big to fail" means that when some very large-scale or critically important enterprises are on the verge of bankruptcy, the government cannot take it lightly, or even invest public funds in it. In order to avoid the huge chain reaction after the collapse of those enterprises, which will cause more serious harm to the society as a whole. In the financial crisis of 2008, it was AIG, several major banks, and the US economy that was too big to fail. As the world's largest economy, under the wave of economic globalization, the United States sneezes and the world trembles. The European economy was greatly affected by the subprime mortgage crisis, and weak countries such as Iceland even went bankrupt. However, the U.S. economy has been able to recover quickly after the pain and continue to dominate the pack. This is the force of being too big to fail.

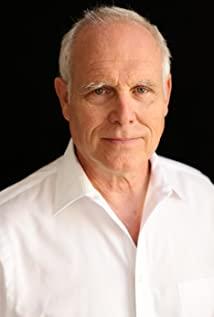

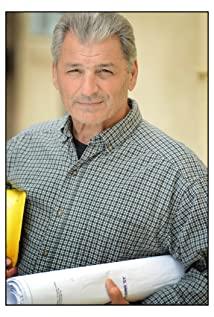

Too Big to Fail is an American TV movie produced by HBO, based on a non-fiction novel by Andrew Ross Sorkin. This film is a "last-minute rescue" from the perspective of a senior official. It has a strong narrative and a lively rhythm. It not only explains the causes of the subprime mortgage crisis, but also restores the "national crisis" in September 2008 for the audience. US Secretary of the Treasury Hank Paulson, Federal Reserve Chairman Ben Bernanke, New York Federal Reserve Bank President Tim Geithner and others made a series of decisions and actions around the "bailout", which is said to be a 2008 Financial crisis science film.

From an official's perspective, seeing all living beings, there is a sense of seeing as a monkey. However, in the face of an unprecedented financial crisis, they tried their best, but they were still stretched thin and embarrassed. In the early morning, when Geithner was running on the street, facing passers-by on the street who knew nothing about the situation, he couldn't help calling Paulson and saying: "People are going to work as usual, completely unaware that the sky is about to fall. Yes." Paulson replied: "We have to go to Congress, we have no choice."

Before the subprime mortgage crisis broke out in the United States, everything was unbelievably beautiful: loose financial regulations gave banks great power, the increasingly prosperous housing market supported the American dream, the Dow Jones and S&P both hit new highs, and Goldman Sachs’ profits soared 93%. %, securities traders and bankers can make $10 million, $25 million, or even $50 million. However, when Secretary of the Treasury Hank Paulson appeared, he was faced with a new story: the housing bubble, the mortgage market collapsed, the number of Americans who lost their homes hit a new high, and 70% of the mortgage companies in the United States failed. Bear Stearns Bank, the fifth largest investment bank in the United States, broke out and was acquired by JPMorgan Chase, and the government participated in the merger. Immediately afterwards, Lehman Brothers, the fourth largest investment bank in the United States, faced a housing crisis and its stock price plummeted.

The operation of the entire financial system is based on the confidence of the people. Once confidence collapses and a run occurs, the financial system and the world will collapse. The so-called rescue of the city is to save the confidence of the people.

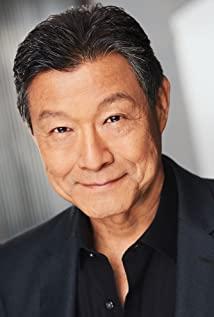

Paulson's first plan was to rescue Lehman Brothers. In the case of deciding not to provide government-level assistance, in order to achieve this goal, he and his team had to deal with major banks in the United States, Barclays Bank in the United Kingdom and other institutions. In the face of the Lehman crisis, the U.S. Treasury Secretary, the chairman of the Securities Regulatory Commission, and the big bankers gathered in a small room. They are: JPMorgan Chase's Jamie Dimon, Goldman Sachs' Lloyd Branfin, Morgan Stanley's John Mack, Merrill Lynch's John Tyne, Citi's Vikram Pandey. Because the interests of all parties were difficult to unify, the final result was the bankruptcy of Lehman, and Paulson's first plan failed.

The collapse of Lehman Brothers directly accelerated Paulson's next crisis, the American International Group (AIG) crisis. Paulson connected a series of calls from all over the world and from all camps, constantly revealing to him the rapidly deteriorating market situation, not only the financial market, but also the real economy, not only the United States, but also Europe. In such an emergency, Paulson defied all opposition and decided that the Federal Reserve would come to rescue AIG.

Next, Paulson and Bernanke need to work together to persuade Congress to agree to the $700 billion rescue bill urgently formulated by the US Treasury Department and the Federal Reserve. Bernanke reminded Congress at a critical moment: "I graduated from studying the Great Depression. If we don't act, the consequences this time will exceed the Great Depression." Still, the three-page bailout plan they submitted failed to convince Congress. At this time, investment banks Morgan Stanley and Goldman Sachs actively rescued themselves, Morgan Stanley merged with Mitsubishi, and Buffett injected 5 billion into Goldman Sachs, temporarily easing the situation. Four days later, despite the revised bailout bill passed by Congress, the market was still deteriorating, and Paulson's side had to carry out the next step - the government to recapitalize the banks. By buying preferred stock in the bank, giving the bank money, the latter lending the money to unfreeze the credit, stabilize the bank and restore confidence. In order to cover troubled banks, healthy banks are forced to get involved. Working together in the face of unprecedented crises.

There is nothing new under the sun. History has seen time and again financial and economic collapses caused by human greed and intemperance. Financial crises are created by the conspiracy of money and power, but they are too big to fail; small people passively participate in the entire financial cycle and ultimately pay for the crisis. In the whole uncertain world, only by actively building the economic foundation and continuously deepening the rational cognition of investment can individuals develop the ability to resist risks and settle down.

View more about Too Big to Fail reviews