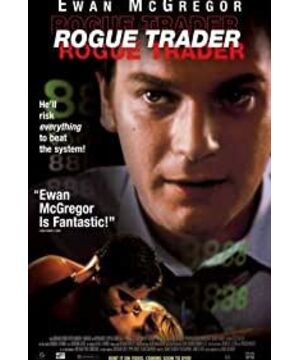

"Devil's Salesman", also known as "How I Broke Barings Bank". The protagonist Nick was promoted from a clerk and was sent to the Singapore branch to open a wrong account 88888 for Pingsheng and use this account to embezzle customers' funds for transactions. At first, it was only to make up for the 20,000 US dollars that the customer lost due to the mistakes of his employees. Later, under the inducement of interests, he continued to use the 88888 account and even made 10 million US dollars for the company in one day.

At this time, the company kept putting pressure on him to reduce the transaction amount while demanding higher returns. He also experienced the miscarriage of his wife. At this time, his mentality was no longer as calm as before, and he hoped that the market would fluctuate with his wishes. .

However, after the earthquake in Japan, the Nikkei index continued to fall, and the wrong account lost 80 million. Under the coercion of the company, he used the client's funds to make up for the loss. However, at this time, the market no longer fluctuated with his wishes. He knew that he would no longer be able to recover, and he and his wife secretly left without How long did it take to know on TV that this account had lost 800 million US dollars, and Barings Bank went bankrupt because of his illegal operations. Nick was sentenced to six-and-a-half years and later contracted cancer in prison, and was released on parole four years later. He once stated that the funds obtained by his illegal operations have never been used by himself...

This has a certain guiding significance for our mentality in investing. Investment needs to adapt to the objective changes of the market, and it needs to have its own strict investment logic. Never feel that you can control the market. A real investment master does not trade all the time, but trades when he sees it right. At other times, he needs to have a good attitude and calmly watch the market in order to hope for the next opportunity to enter the market.

There's a saying, "The retail investor loses money because he buys stocks in both bull and bear markets." There's some truth to that. First, retail investors have insufficient knowledge and information; second, they do not have enough time to monitor the market or learn investment knowledge to build a complete investment system. Therefore, when the overall market situation is good, you can enter the market for short-term operations, or value investing in medium and long-term operations, but if you want to operate all the time of the year, and only look for one investment logic, such as blindly chasing high. In this case, when the market risk increases and the sector switches rapidly, it is very likely that all the high profits obtained by chasing the high will be taken back, and even the deep trapping will not be able to extricate itself (standing on the top of the high mountain...)

In the financial system, in order to prevent financial crises and promote the stable and orderly development of the economy, it is necessary to formulate strict rules. Even in the relatively developed financial system, there are still various forms of financial crimes, such as insider trading, online loans for college students, etc., which exploit the loopholes in financial supervision or wander in the gray area. Fortunately, regulators are constantly adapting to financial innovations and formulating laws and regulations, so that the financial system tends to operate in a standardized and stable manner.

View more about Rogue Trader reviews