"Author: Hyun Bin Dirk

Link: https://www.zhihu.com/question/ 23372653/answer/45545227Source

: Knowing

that the copyright belongs to the author, please contact the author for authorization.

This problem is very simple, as long as anyone who has operated futures can understand.

Futures trading has two characteristics, one is high leverage, the other It is a two-way transaction (buy long and short)

this frozen orange juice. The opening price is more than 130. At this time, Duke Brothers, because of the false report that the production of oranges has decreased, concluded that the price of orange juice will increase (the principle of supply and demand), so they bought a lot. buy in, and other traders see them buying, decide they have inside information, and follow suit and fry orange juice bubbles to highs of 145. This is the first part.

Since win and val know in advance that orange production is not in fact Affected, so the price will not go up in the future, so they sell orange juice at the high of 145 to absorb the longs in the market. At this time, the price falls in their favor. This is the second part. The

Minister of Agriculture announced the oranges The output has not been affected, so everyone understands that the price of orange juice will not rise in the future, and the contract prices in their hands are high, so they are eager to close their long positions. Because they were "buy" before Go long, so they close the position and shout "sell" to sell short. But because there are more bears than bulls in the market at this time, the price drops sharply. When the price is low, win and val pass again" buy" to close their previous short positions and realize profits.

I am not very sure about the rules of futures contracts in the United States at that time. We calculated according to the assumptions of the Chinese market. Now, the general leverage of commodities is about 1:10, and the margin is also assumed to be 10%. Win and val cost $14.50 to buy a lot of orange juice at the high level, and the cost to close the position is $2.90, so they earn $145-29=$116 per lot. The yield is as high as 800%. In one day, their assets increased eightfold. That's why they ended up becoming rich.

But the film, in the final analysis, still has some artistic elements and exaggeration in it. In terms of win and val, who were impoverished at the time, where did the principal come from? ? ? You know, the premise of earning $119 is to have a cost of $14.50. If at the pace they can afford a yacht, let's say they make $11.9 million, then they have to cost at least $1.45 million. Of course, if they continue to increase their positions during the day, it will be another matter, but the cost must be a certain amount, but they should not have that much money at that time.

Secondly, win has lost his job and was disqualified from the exchange, and it is obviously illegal for him to trade in the exchange at the end.

Then there is such a big shock in the day, it will definitely attract the attention of the US regulatory authorities, and win and val are involved in insider trading, if they are investigated, it is also illegal.

Then, it is impossible for the above situation to occur in China's futures market, because China has a price limit, and commodity futures are generally 4%-5%, which means that if the opening price of 132 US dollars falls to 125.4 in China It will close the board and stop trading, and it is impossible for the price to fall to the position of 29.

So, just watch the movie, don't have any illusions that shouldn't be there~"

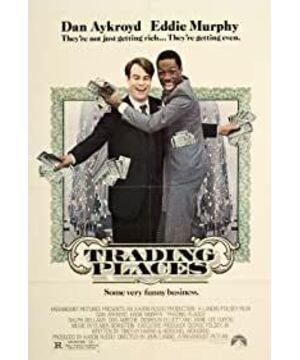

View more about Trading Places reviews