ZF rescued the market, right? Isn't it just a lie to revive the confidence of investors?

In heavy gold and crude oil, leverage is a terrible thing. Because the landlord is doing crude oil, I will use crude oil as an example to explain how leverage can make you step into the cloud and how to make you fall into hell!

Due to the high price of crude oil, crude oil is traded on margin. You only need 5% of the price to play crude oil. This is equivalent to 20 times leverage. Crude oil fell sharply last night, MB fell from 2500 to 2399, more than 100 points. If you buy Qianhai Oil 100 in one hand, you will earn 10,000 yuan directly. If both hands are 20000. Does this kind of money come as fast as the wind blows? That's the magic of leverage! Of course, if you lose, you will also lose 20 times.

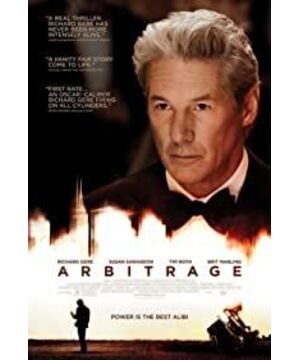

This movie is like that. The male protagonist invests in a copper mine, and this is also a way of leveraged investment, so he invests 400 million, and because he misreads a step, he will lose 4 billion, which means that his leverage is 10 times. So he was desperate to find someone to buy his company and mortgage it out.

This is probably the background. This film is a good film about how to chase money and how to use it.

The humanity in it is on full display.

After watching this film, I have to admire the mind of the male protagonist. Others would have jumped off the building long ago.

Therefore, people who jump off the building are stupid B, and those who pay 4 billion to survive and find a solution are the real B!

View more about Arbitrage reviews