Who is this? Nick Leeson,

a futures and options staff member from Morgan Stanley, joined Barings Bank on June 16, 1989, and in March 1991, Nick Leeson returned to London. His success in Jakarta and his training at Morgan Stanley made Nick Leeson a specialist in futures and options settlement.

Of course, in the subsequent overtrading of derivative financial products in Singapore, speculation failed, resulting in a loss of US$1.4 billion. The Bank of Barings collapsed on February 26, 1995. This is Bahrain's second bankruptcy, the first being in 1890, when Bahrain's investments in South America evaporated with the revolution in Argentina.

The bankruptcy of Barings Bank must be familiar to you! Let's review together!

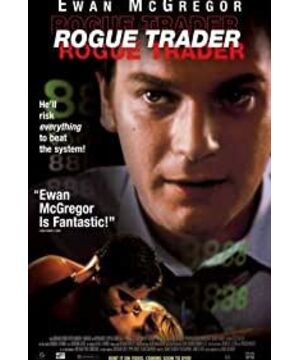

The film is based on Nick Leeson's prison book "How I Get Over Barings Bank", so the point of view is the originator himself.

Nick Leeson just wants to make up for his mistakes, he is too confident in his luck, and the elites may often make monstrous mistakes without supervision and excessive laissez-faire, and they need to pay the full price. His mysterious account did not win for himself, and a top trader in Singapore and even in the Asian market, he forgot one basic principle: never fight the market. Anyone must respect the market and laws, and the power of huge wealth is enough to distort human nature.

Some facts, not shown in the video, are reproduced here:

"No matter what transaction you do, mistakes are inevitable, but the key is how you deal with them. This is even more true in futures trading, for example, someone will "buy" The gesture is mistaken for a "sell" gesture, someone might buy a contract at the wrong price, someone might not be cautious enough, someone might buy March futures instead of June futures, and so on. The bank has caused losses. After these errors occur, the bank must deal with them quickly and properly. If the error is irreversible, the only feasible way is to transfer the error to an account called "error account" in the computer, and then report to the bank. Headquarters report.

When Lisson worked as a futures trader in Singapore in 1992, Barings originally had an "error account" with an account number of "99905" to deal with errors caused by negligence during the transaction process. This turned out to be a normal error account in the operation of the financial system. In the summer of 1992, Gordon Bowser, who was in charge of the liquidation work at the London headquarters, called Lisson and asked Lisson to set up another "error account" to record minor errors and deal with them in Singapore so as not to trouble London. work. So, Lisson immediately called Lissel, who was in charge of the office's liquidation, and asked her if she could set up another file. Soon, Lissel was typing some commands into the computer, asking him what account he needed. In Chinese culture, "8" is a very auspicious number, so Lisson uses it as his auspicious number. Since the account number must be five digits, the "wrong account" with the account number "88888" was born. .

A few weeks later, the London headquarters called again. The headquarters was equipped with new computers and asked the Singapore branch to follow the old rules. All error records were still reported directly to London from the "99905" account. The "88888" wrong account has just been created, and it has been put on hold, but it has become a real "wrong account" stored in the computer. Moreover, at this time, the headquarters had noticed that there were many mistakes in the Singapore branch, but Lisson subtly prevaricates them. The neglected account "88888" provided Lisson with the opportunity to create false accounts in the future. If this account was cancelled at the time, the history of Bahrain might have been rewritten. "

On July 17, 1992, Kim Wang, a trader under Lisson who joined Bahrain for only one week, made a mistake: when a client (Fuji Bank) asked to buy 20 Nikkei futures contracts, the trader Mistakenly sold 20 copies, a mistake that was discovered during Lisson's liquidation work that evening. To rectify this error, 40 contracts must be bought back, representing a loss of £20,000 as of the day's closing price, and should be reported to the head office in London. However, under various considerations, Lisson decided to use the wrong account "88888" to undertake 40 short Nikkei futures contracts to cover up this mistake. In doing so, however, Lisson's transaction became a "proprietor transaction", exposing Barings to risky positions in this account. A few days later, as the Nikkei rose 200 points, the loss on the short position increased from £20,000 to £60,000 (note: Lisson was earning less than £50,000 a year at the time). At this point, Lisson even dared not report the mistake to the top.

Another similar mistake was made by Lison's friend and executor, George. George divorced his wife, was in pain all day long, and started giving up on himself. Lisson liked him because George was his best friend and one of the best traders. But soon George started making mistakes, and Lisson indicated that he had bought all the 100 September futures he had sold, worth as much as £8 million, and that the documents for several of the trades were not filled out at all.

If George's mistakes leak out, Lisson will have to say goodbye to his already happy life. It was easy for Lisson to record several mistakes made by George into the "88888" account, but at least three problems plagued him: first, how to make up for these mistakes; second, how to hide after the mistakes were recorded into the "88888" account After the internal audit at the London headquarters at the end of the month; thirdly, SIMEX asks them to add margin every day, they will calculate how much the Singapore branch loses every day, and the "88888" account can also be displayed on the SIMEX big screen. In order to make up for the mistakes of his employees, Lisson transferred the commissions he earned into the account, but of course, the premise was that these mistakes should not be too large, and the amount of losses caused by them was not too large, but the mistakes caused by George were indeed too big.

To make enough money back to cover all the losses, Lisson took increasing risks. He was engaged in a large number of straddle positions at the time, and because the Nikkei was stable at the time, Lisson earned option premiums from the trades. If unlucky and the Nikkei fluctuates wildly, the deal will cost Barings a lot. Lisson was doing pretty well for a while. By July 1993, he had turned the "88888" account's loss of 6 million heroes into a slight surplus. At that time, his annual salary was 50,000 pounds, and his year-end bonus was nearly 100,000 pounds. If Lisson stops there, then the history of Bahrain will also change.

In addition to covering up mistakes for traders, another serious blunder was to win over Nikkei's biggest client in the market, Pony Foy. In late 1993, for several days, the market price skyrocketed by more than 1,000 points every day, the computer screen used for clearing records frequently malfunctioned, and the entry of countless transactions was backlogged. Because the system didn't work properly and transactions were recorded manually, by the time various errors were discovered, Lisson had lost nearly $1.7 million in one day. With nowhere to go, Lisson decided to continue to hide these mistakes.

In 1994, Lisson was numb to the amount of losses. The losses on the "88888" account ranged from 20 million to 30 million pounds to 50 million pounds in July. In fact, many of the trades Lisson made at the time were led by the market trend, not because of his expectations for the market, he had become a puppet manipulated by his risky positions. What he could think about at the time was which direction of the market movement would make him turn a defeat into a victory and make up for the losses in the "88888" account, so he tried to influence the market to move in that direction.

Lisson described in his autobiography: "I'm ashamed of myself for being such a liar - a relatively small mistake at first, but now it's all around me like cancer, and my mother definitely didn't raise me to be This is what it looks like."

http://baike.baidu.com/view/1210907.htm

It is ironic that Barings Bank, which is blindly pursuing the "trend", has ended up in such a way that there is no technology at all! ! !

This mason's son was finally beaten back to its original shape by the market because he had no real market knowledge. At the same time, he also told us how important luck is to come out and mix! Unless you really have super mystery customer X supporting you all the time!

View more about Rogue Trader reviews