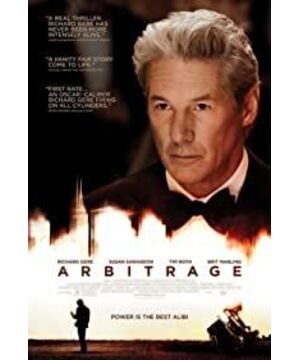

View more about Arbitrage reviews

I analyze the $400 million problem in the film from the point of view of arbitrage trading

Jaleel 2022-03-23 09:02:29

-

Ines 2022-04-23 07:03:07

Perhaps it is to tell us that if a person, wife, lover, children, family, career, wealth, fame... all want to take up everything, then what he does is not balance, but walking a tightrope. Even if he succeeded in maintaining the apparent harmony in the end, once he was restrained, he was no longer himself.

-

Dagmar 2022-03-27 09:01:12

I really have no interest in the various crises of middle-aged men, and is it necessary to use so many powerful actors for such a tepid film? . . waste

-

Det. Michael Bryer: [talking on the phone] Yeah... I need a serious fucking favor.

-

Robert Miller: But this is something we've seen over and over again. Time and time again. The competition for this limited amount of dollars out there can make the best of us manic. So it's not surprising that we have these asset bubbles. But when reality sets in, of course, they burst.