400 million US dollars is not a shortfall; it should be used to fill the futures margin for shorting copper. Because he is shorting and the price of copper is rising (as explained at the beginning of the film), there will be a loss on the book of his shorting copper futures position, and he needs to add a margin. If he can hold on and the Russian copper mines continue to be profitable, the sale of spot copper could bring huge cash flow. The result of the arbitrage trading of copper in the futures market at the beginning was that no matter whether the copper price rose or fell, as long as the spot copper can be shipped normally, it will bring huge profits. It's just that the Russian government is temporarily in control, which has caused a setback in spot copper transactions, and also caused problems with his company's cash flow, requiring short-term borrowing from others. However, the mining rights of the big copper mine in Russia are also valuable. On the whole, the company is also valuable, but there is a short-term cash flow problem. This is also one of the reasons why the next company that takes over its company can endure the misappropriation of 400 million US dollars in book funds.

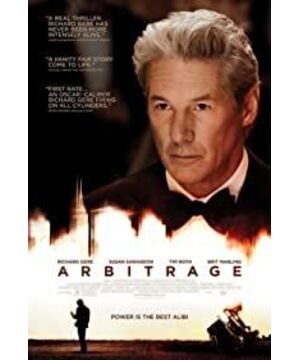

View more about

Arbitrage reviews