The timing I got this nomination is well worth pondering given the huge pressure Enron's top executives face to boost the stock price after its continuous commercial debacle in South Asia and Latin America. A decade ago, our brainy lobbyists forayed into the Congress and actualized the deregulation rules regarding natural gas transaction. Then our business soared up and the productivity of statesmanship gained far-ranging appreciation as our stocks did. Since the road to bonanza was paved, a culture complex of opportunity exploitation came into shape and a cult of personality was fostered , amounting to a bizarre reality metaphored by the consensus belief that smart brain and skilled manoeuvre would defeat the normal operation of the system. Before my promotion I got used to handling every deal as a technical task,just as I drafted all the research proposals and experimental models back in college. Joining the decision-makers, however, I need to come up with my own moral models besides overseeing traders' daily performances. I find myself caught in a swirl of dilemmas, most of which constituted by the hardship of repositioning my moral fitness. I already knew that this is a business terrain hallmarked by irregularity, but these irregularity patterns are now manifested more and more clear to me as a variety of deregulation efforts. Many dense examples filled my vision and make me come to realize a very difficult business landscape ahead of us—that the corporation is breaking apart from inside with so much space for subjective for will power. From employees to top executives, everyone is a stakeholder of this quagmire and could not escape.

Or could someone? I am projecting, based on my beholding of events. As the deputy of Lou Pai, the CEO of EES and head of Enron Xcelerator (a venture capital division of Enron), I now have both the privilege and time excessing the comprehensive end-of-month summary on gains and losses, the pitch books giving predictions to EES's next move, and the comprehensive financial reports suggesting the bonus apportions in my zone. No doubt the last item draws my attention the most, and I have every stance to reflect on the causal link among these items. What struck me is that the numbers obviously don't match, to a stunning degree. What struck me more is Lou Pai's response when I approach him with my doubts.

"So you found out, hah? I knew it wouldn't take you so long... You come to me for an explanation, but you could already speculate that these forged numbers are not for EES alone, and they did not exist for just one day. They come up since things went beyond our control, and someone has to do something about it. Who could expect the Indians won't pay for their gas pipelines? Who knew the imbeciles at Azurix could lose that load of money? Who won't play by the mark-to-mark rule to have some joyful numbers to look at? Who would like to envision Enron's doom when your life's work is at this place? I know it, Lay knows it, Skilling knows it. Even THEY know it. But real smart people don't tell. Most people don't really want to find proper means of making a life, but to find a job, do it long, waiting for the salary go up slowly.Because what everyone wants is peace, always keep his status—oh yes, especially in Enron's hostile condition— so there won't be any real revolution. People like Skilling see this long time ago, so they pretend to know nothing and villains don' t quit. It's that simple.”

“So the Emperor has no dress on and no one bothers to notice, or admit, even if everyone holds stake in it? Wow, this is truly revealing. Thanks for being a man to tell me this. Now I finally know something that was kept from me before.”

“It might be better that you don’t know, Kate,” Lou Pai alters to a flatter tone, “You ever considered why the board promotes you, even your trading record isn’t among the best?–don’t get me wrong; you are visionary, but you lack the visions for strategic planning, or double standards in walking the line as we do—but that's what we need. We are in need of a figure that represents the so called goodness, someone who can boost employees' confidence and stabilize the market–a woman like you, advanced so rapidly from the ground level and seldom try the rogue style. And when all this go to bluff they are going to believe that you knew nothing, and they have bigger fish to catch. But we are the men. We get ready and no one can touch us. Enron didn't just sustain on business growth. We knew how to handle people—people at Anderson, people in SEC,people doing stock speculations, people working below us. It's always the way the world works. You are smart enough to know what I am talking about and suggesting you not to do. Now, our time is up."

I have subverted many times my worldview since I stepped into the jungle of trading, none of which refreshes my mind frame as strikingly as the naked truth pushed into my horizon in Lou Pai's office. The first thing that comes to my mind is whether I should be the smart guys ' public enemy and go to the press. Given the undesirable status quo—which must be arrived at with lots of interest complication and menace—and they achieved this goal, I am the only person with credibility and information access. Lou Pai didn't act a slight sign of panic but he might be already on his way to making some phone calls. After all, the “headline a new girl” manoeuvre is all about “keeping your enemy close “now. What possible options of act are left there? Is it really worth, or even justifiable,to expose their financial instruments for their questionable legality? The miscellaneous offshore accounts, special purpose entities, projections of future cash flows, etc., their very existences, are they part of the innovation called upon by the time, or the dark shadow of financial excess along with the political cynicism? What I have been doing in the last decade, trading, despites its name as a form of art, isn't it a zero-game inviting every human being to exhibit the frailty so that we can carry on the Faustian deals, just like what the top executives are engaged with? Probably due to the long-time held professional courtesy, I cannot help trying to blur the ethical lines for these people and consider what options are left for them besides admitting failure when the first unrecoverable losses are made. I fail come up with one,maybe because somewhere deeply in my heart I reckon that the jungle of laws would perpetuate its own significance as long as human beings carry the seven sins.

There is one thing I am absolutely positive about, that Enron will have its crash come in no time: a result clear from the beginning. The ship is sinking, and the higher-ups are already life-vested. If I go to reporters right now, what motivator do I have except for the beckoning of morality? This option is immediately ruled out, once I realize that it does not save the corporation, only accelerates its plunge into bankruptcy. Besides no marginal benefit could arise from this seemingly sublime act —I appear in front of the media as a Joan of Arc, and then what? The employees still endure huge loss in their investment fund, and their whole faiths in this corporation threw to the winds. It is not an impasse of moral challenge once I finish the calculations and come up with the most morally, and secularly, expedient plan:to get off board and transfer to another express, say, hedge funds.

In less than ten minutes I finished writing an e-mail to Lou Pai, explaining my reasons for leaving the company—that several transactions under my surveillance have gone rotten, which indicates my incapacity in fulfilling my job. I propose to him that I resign from the position and start a hedge fund with old friends from Yale, leaving large trunks of my stocks unconverted in exchange for a smooth resignation. A salient advantage of dealing with smart people is that the leverage of resourcefulness always exists. Lou Pai knows that I would not expose them in a foreseeable future, since I am going to take a firm stance in shorting Enron stocks in my hedge fund. The retaining of my stocks could be used as a plea for my ignorance of the upcoming upheavals, while the bearing strategy could be explained as a form of portfolio diversification,a philosophy that hedge funds always hinge on. The gains I make from this deal would build my professionalism in the hedge fund industry and cover all the losses caused by Enron's stock crash, and may even provide enough space for a special purpose fund that make up for Enron employees' shrinked pensions. While Yale persistently delivers the motto of “Light and Truth” to every generation of its students, this is the time for both morality and Wall Street smart to deliver their worthiness. We live in a world where pluralism in values grows as fast as the diversification of financial instruments, and I could use an oasis to temporarily reside in if it could rightly dispel any moral challenge I face.The gains I make from this deal would build my professionalism in the hedge fund industry and cover all the losses caused by Enron's stock crash, and may even provide enough space for a special purpose fund that make up for Enron employees' shrinked pensions. While Yale persistently delivers the motto of “Light and Truth” to every generation of its students, this is the time for both morality and Wall Street smart to deliver their worthiness. We live in a world where pluralism in values grows as fast as the diversification of financial instruments, and I could use an oasis to temporarily reside in if it could rightly dispel any moral challenge I face.The gains I make from this deal would build my professionalism in the hedge fund industry and cover all the losses caused by Enron's stock crash, and may even provide enough space for a special purpose fund that make up for Enron employees' shrinked pensions. While Yale persistently delivers the motto of “Light and Truth” to every generation of its students, this is the time for both morality and Wall Street smart to deliver their worthiness. We live in a world where pluralism in values grows as fast as the diversification of financial instruments, and I could use an oasis to temporarily reside in if it could rightly dispel any moral challenge I face.While Yale persistently delivers the motto of “Light and Truth” to every generation of its students, this is the time for both morality and Wall Street smart to deliver their worthiness. We live in a world where pluralism in values grows as fast as the diversification of financial instruments, and I could use an oasis to temporarily reside in if it could rightly dispel any moral challenge I face.While Yale persistently delivers the motto of “Light and Truth” to every generation of its students, this is the time for both morality and Wall Street smart to deliver their worthiness. We live in a world where pluralism in values grows as fast as the diversification of financial instruments, and I could use an oasis to temporarily reside in if it could rightly dispel any moral challenge I face.

After immersing in the hedge fund realm for years, I get along with a system of operation criteria that I diligently rebuilt in series of transactions. When prioritizing the list, I propose that the optimal policy would be guarding the fruit of your labor with a defensive stance in the time of uncertainty. The years at the trading desks of Enron still haunt me. In an object view these experiences help shape my temperance in making deals and avoid disasters as my former employer underwent. To fight a protracted war there are technical and moral lessons to learn, and the sunk ship of Enron made a impressive enough case.

The flashbacks come at the inadvertent moments. In my years at Enron, at various occasions I could encounter Jeff Skilling and Ken Lay sharing visions and passions with people, portraying the collective interests. Their downplay of crony capitalism in enterprise management enables career advances for people like Lou Pai and me, yet the insider trading convictions are obliterating the positive side manifested in them and cloaking them with the ultimate form of moral inaptitude I could imagine. Lou Pai would be another form of negation I could propose. Intriguingly, Lou Pai and I share many common grounds. We are both math whizzes coming from immigrant families, and he has an Asian face while my gender is female.We both define ourselves by an intense work ethic and a drive to succeed on all fronts and thus value what our brains could bring to us in the trading realm. What is more, he has been my earliest coach and training partner since the start of my trading career. We broke off when our ranks get the closest, and we both dodged the punishments ensuing the money exploitations in our own way. God has his invisible hands never to be speculated. In a restless country as US is, everyone look forward to the unknowns and temptations. The sunlight that shined upon me the last day I walked out of the Enron's building reminds me of the neon light from the strip bars Pai once frequented, just like the holy light falling upon the celebrities gathering at Lay's memorial meeting. This is a sign of our era, filled with flatulence and passion, fervency and vanity.The supply of arrogance never fall shortage, but the question is, could we ever learn.

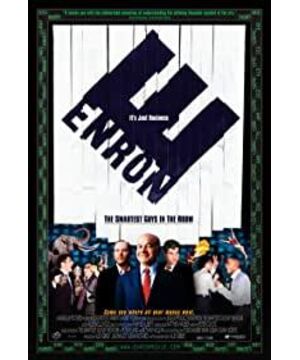

View more about Enron: The Smartest Guys in the Room reviews