director does not go over the wall, he can see only 2 works of the director Charles Ferguson of this film.

The other is "Boundless" in 2007, which recorded the Iraq War in which "a dozen people sat in the office and patted their heads to decide the fate of millions of people", and showed the world a picture of "the war under the rule of the US military". Iraq is 'worse than Saddam'". The film was also nominated for an Oscar for Best Documentary Feature in 2008, but was narrowly defeated by the Afghan war documentary "Rent to the Haze".

From the works of this low-key director, it is not difficult to find that he is an "angry youth", and he may not rise to the height of "populism" that some people call it. After all, no matter what he covers up in the editing, the historical data, data, and even interviews in the film are all based on the truth. It's just that these artificially chosen "truths" directly point to the "guardianism" of a small group of people.

This may be in response to the old documentary filmmaker Blanchett's words, "Art is not a mirror that reflects reality, but a hammer that shapes life." If the director chooses a mirror, it may not be presented in an orderly manner like the current film. And he held the hammer with focus, hit the arms of some big bosses, and made us start to pay attention to a layer that we rarely get involved in our daily life - the macro economy.

The beautiful Iceland at the beginning

was chosen as the entry point of the whole film. With the "most unconventional experimental relaxation" in the financial world - the privatization of banks, within five years, these three small banks started a never-before-seen Icelandic relationship. Operational experience outside: $120 billion in loans, which is ten times the size of the Icelandic economy combined.

A huge bubble formed. Shares rose 9 percent and house prices nearly doubled. The headlines of the newspapers were also occupied by the acquisition of a company in a certain country by a young rich man who was on the rise. And those special font titles don't tell the truth: these bubble-inspired millionaires are "loaning" billions of dollars to start companies, buy fancy private jets, expensive yachts and in downtown Manhattan. Penthouses...and the money is all from the national bank.

Subsequently, the bank set up a money fund and advised depositors to withdraw their deposits and invest in the money market, "like a Ponzi scheme, searching for money everywhere".

The credit rating of Iceland's banks and investment firms by U.S. accounting firms has been declared "perfect", and Iceland's own commission of inquiry raised it to the highest AAA rating. The government and bankers put on a PR show together.

At the end of 2008, this gorgeous show collapsed. The world began to pay attention to Iceland, where a large number of people went bankrupt. Perhaps, "financial power is more or less disruptive." But, "This is a global problem, right? Doesn't New York have the same trouble?" The

narrative is

at this point, the music plays and the actors appear.

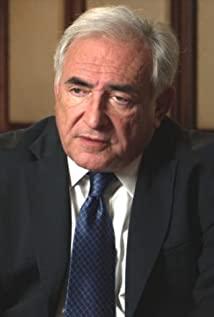

Former Chairman of the Federal Reserve, Executive Chairman of the International Monetary Fund, Financial Giants, Chairman of the US House of Representatives Finance Committee, Deputy Treasury Secretary of the Bush Administration, Chief Negotiator of the Financial Services Roundtable, Chief Economic Advisor of China Banking Regulatory Commission, Prime Minister of Singapore, Minister of Finance of France, Editor-in-chief of Financial Times, professor of NYU Business School, dean of Columbia Business School, former governor of New York State, psychologists...and of course the "actors" who refused access, like Greenspan and Larry Summers.

These heads are either fierce, or retreat to him, or angrily berate reporters. Their presentations were cut into several paragraphs and put into four parts by the director:

Part 1: How we got here. With the bankruptcy of the US investment bank Lehman Brothers and the collapse of the largest insurance company AIG, a worldwide economic crisis was triggered. Stock prices plummeted, U.S. national debt soared, workers lost their jobs, and 50 million people around the world will fall back to the poverty line...

Since the deregulation, some of the world's top financial companies have been found to be engaged in money laundering, extorting customers, making false accounts, and again and again. The crisis didn't come out of nowhere, it was caused by a runaway financial industry. It's also a "weapon of mass destruction," as Buffett said.

Part 2: The bubble (The bubble 2001-2007) Some executives on Wall Street will "go to strip clubs, take drugs, and often call prostitutes" in their spare time. Davis organized a group of senior prostitutes in his condominium, just steps from the NYSE. Among her more than 10,000 customers, high-end customers such as Gaosheng, Lehman Brothers and Morgan Stanley account for half. These services will be invoiced for legitimate reasons such as computer repair, trade research, business information, etc.

Meanwhile, statistics from Goldman Sachs show that, on average, 99.3% of homebuyers are taking out loans. Such a volatile loan has an AAA rating as safe as a national debt.

Part 3: The crisis "We watched the tsunami come, but we are still proposing, what kind of swimsuit should we wear?" Henry Paulson of the G7 summit in February 2008 made a vivid metaphor for the crisis. Just a month later, the Bear Stearns investment bank ran out of assets, and Lehman Brothers announced a $3.2 billion loss on accounts. Both of them were rated A2 before bankruptcy, and AIG, Citigroup, and Merrill Lynch all had high investment evaluations.

At the same time, there are more and more people in the tent area, mostly because of unemployment.

Part 4: The history of Accountability came to 2009. Those who made the company go bankrupt and plunged the world into crisis escaped unscathed. What cannot be receded is the highest unemployment rate in 17 years.

In the same year, Morgan Stanley paid employees $14 billion in compensation, while Goldman Sachs paid more than $16 billion.

Ending

"Why does a financial 'engineer' earn 4x or even 100x what a real engineer does? Real engineers build bridges, and financial engineers build dreams. When those dreams turn into nightmares, someone else needs to pay. ” said Shen Liantao, chief economic adviser to the China Banking Regulatory Commission.

"The financial industry has betrayed society, corrupted the political system, and plunged the world into crisis. Those 'bootleggers' who claim we need them are doing something complicated and incomprehensible. They promise it won't happen again, but still Invest billions in resistance to reorganization." None of

this will be easy.

Such real pictures, language, historical materials and the names of the real beings who were named tell the viewer that this is not a movie. Faced with such a smooth narrative, we may all gasp: "Too shameless, too much, too much (the number of crosses omitted here)!"

For documentaries, there will be no more Iriot in "Murder in the Cathedral" It is more true that "Humans cannot tolerate too much truth." Then, it only depends on how to present the truth. So, at the end of the film, the director chose to jump out of the narrative, giving the viewer another level of vision:

"But at least there is something worth fighting for." The opposite picture is the Statue of Liberty.

View more about Inside Job reviews