The eye of the film’s financial crisis. The headquarters of a certain investment bank in New York is undoubtedly one of the five largest investment banks in terms of scale and business operations. Some friends said it was Goldman Sachs or Lehman. From the perspective of scale and later ending, Lehman made more sense; but from the perspective of acting style, it was undoubtedly more like Goldman Sachs.

What they do is simple. Investment banks buy large amounts of housing loans from commercial banks and mortgage borrowers, then package them into so-called MBS (Mortgaged-backed securities), and then sell them to investors to make a profit. Borrowers changed hands to risk, so they opened the gates more boldly to lend, investment banks only changed hands and the rewards were generous, so they were more aggressive in buying loans. Rating agencies are happy to give ratings based on theoretical models, while investors can enjoy the ratio. A much higher AAA-level investment return on national debt. This kind of business model has flourished in the first seven years of the 21st century, and major investment banks have made a lot of money. The courage of both borrowers and lenders, combined with the low interest rates in the Greenspan era, promoted the prosperity of the housing market and was able to support the booming US economy after the Internet bubble, so that the whole world was exclaiming the magical power of "financial alchemy".

However, maybe the bubble is too beautiful, and it is so beautiful that everyone forgets the truth that they have learned in the financial basics course of the first year of university: rewards are always accompanied by corresponding risks. This means that no one can earn a return that exceeds the risk-free rate of return without taking any additional risks, even if this product looks perfect from the mathematical model. This also means that when you see MBS and CDO, which are the same as US Treasury bonds with much higher AAA-rated yields, flooding the market, you should instinctively realize that the music is about to stop.

Similar to the crash of long-term capital management companies more than ten years ago, at the climax, someone suddenly yelled: "Fuck, the model is wrong."

Then this is what you see.

There are not too many you and me, there are not too many emotional entanglements, and there are no tacky men and women in the plot like the upper body of the literary youth. This is another reason why I have a good impression of this movie. Except for the HR at the beginning and the aunt of the cleaner who had a glimpse in the middle of the film, the only female character in the film is the head of the risk management department, and the only time the female head shows off his emotions is to press the elevator door ruthlessly. Ruthlessly warned colleagues: "You fucking don't want to stab me in the back", coldly and don't grab a murderous look.

This is very much in line with the face of the industry I have seen.

The director’s handling of details is not lacking in several highlights, such as the footage of two executives and the cleaner in the elevator. In the tens of seconds of freeze-frame continuous footage, the changes from the arrangement of the characters to the changes in their respective expressions are really interesting. The only flaw in the magical feeling is that there is too much nonsense in the elevator room, the freeze frame is still too short, and there is a little lack of deep background music.

Another interesting clip is the words of a Wall Street veteran who educates newcomers in the early morning in New York, driving a luxury sports car across the East River to the company:

"If you really want to do this with your life you have to believe that you're necessary. And you are. People want to live like this in their cars and their big fucking houses that they can't even pay for? Then you 're necessary. The only reason they all get to continue living like kings is because we've got our fingers on the scales in their favor. I take my hand off and the whole world gets really fucking fair really fucking quickly and nobody actually wants that. They say they do but they don't. They want what we have to give them, but they also want to play innocent and pretend they have no idea where it came from. That's more hypocrisy than I'm willing to swallow. Fuck them. Fuck normal people."

In just a few words, without walking, instantly let this movie and the preaching film of literary youth like inside job stand out. Yes, this world is terrible, terrible. But blaming the horror of this world on the greed and evil of a small group of people in order to gain a sense of moral superiority outside of the matter will not help us to see what we are. Any idea that, by eliminating a group of people or occupying a street, the evils of the world and the peace of all ages can be overcome, it can only be too simple sometimes naive. Since Eve's gluttony caused human beings to come into this world, greed has never been exclusive to a certain group of people, it has always been the racial talent of each of you and me. If you don’t believe it, you can suggest going back to the streets of Amsterdam more than four hundred years ago and looking for the precious “Eternal Augustus”.

The biggest flaw may be that the director set up the atmosphere too high in the first half of the film, so that in the end he didn't know how to shoot these thrilling clearance hours-it stands to reason that the most important thing in the whole movie It’s a few hours that it is impossible to do in theory or in reality; or the director is so tired of the narrative style of the first half that he has no time to unfold in the end. Anyway, he simply chose to evade: After recording a few phone calls, he gave a hasty explanation, and molested the audience in front of the screen.

It's really a pity.

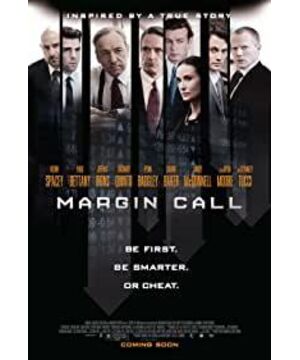

There are many classic lines in the movie, such as the sentence everyone is mentioning: "There are three ways to make a living in this business, be first, be smarter, or cheat."

When I got out of the movie theater, I made up one for it. Follow-up: "There are three ways to make an excuse in this business, blame the Feds, blame Rothschild, or blame Goldman Sachs"

View more about Margin Call reviews