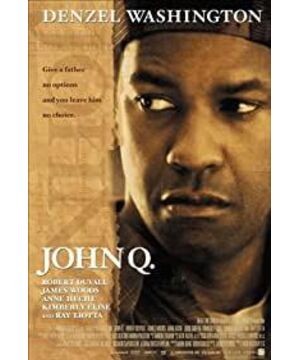

This is a too heavy topic. In the film, John Q said in tears to his dying son the following 8 items. This is a summary of his life experience and a condensed of his love and expectations for his son. Not touching:

1. you always listen to your mother, do what she tells you to do,she is your best friend, tell her you love her eveyday

2. You treat them like princess (girl friend), because that's what they are

3. When you say you gonna do sth, you do it.

4. you make money if you get an chance, even though you got to sell out someone....Don't be stupid like your father. Everything would be so much easier with money

5. No smoke

6. Be kind to people, but somebody chooses you, be a man

7. Stay away from bad things, so many great things out there for you

8. I'll never leave you, I am always with you, right there. I love you son.

Especially articles 3 and 6, I think are two very important points for educating a child to an adult.

View more about John Q reviews