The whole film is very storytelling, which is easy to make people interested, and the film uses a variety of methods such as witty exaggeration and irony, which is very eye-catching. Regarding the successful reversal of the last two, I found the answer in reading Xue Zhaofeng's economics lectures today. The Duke brothers mistakenly believed in false news that frozen orange juice would rise in the future, so they bought a lot, and other investors followed suit, creating a false appearance that the price of frozen orange juice soared in the short term. At this time, Louis and Billy acted as sellers, and they chose to sell at a higher price. Finally, when the Secretary of Agriculture announced that the production of oranges had no effect, it meant that the price of oranges would not rise. The Duke brothers had to pay for the difference in orange juice and the premium in the futures market, while Louis and Billy only had to pay a low price at this time. Buying is equal to the high price of the previous selling, so that the difference is made. The second financial movie I watched recently, in summary, is human greed and game. However, in countries where public ownership is the mainstay and multiple ownership systems develop together, the state is the stabilizer behind it and will not be manipulated by the market. Therefore, as Xue Zhaofeng saw, the futures market is not a zero-sum game but a positive-sum game, redistributing risks. So as to enhance the happiness of the public!

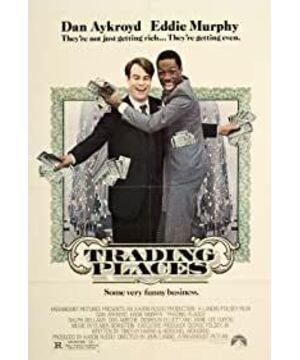

View more about Trading Places reviews