Please see the following brief introduction to the Danish tax system: "In Denmark, the total amount of tax collected is about 50% of the gross national product (GNP), and most of the tax collected by the government is used for social security, such as education, childcare services , unemployment benefits, health care, pensions, early retirement security, and other social welfare undertakings. Therefore, Denmark is a typical high-tax, high-welfare developed country. Among the taxes levied in Denmark, personal income tax (Personal Income Tax (Personal Income Tax) Income Tax is the most important of them, accounting for almost half of the entire tax. Other taxes include Value Added Tax, Excise Duties, Corporate Income Tax and Labour Market Contributions According to statistics, in 2002, in the total tax revenue in Denmark, personal income tax accounted for 44.60%, value-added tax accounted for 21.20%, energy and consumption tax accounted for 12.70%, labor market contribution accounted for 10.00%, corporate income tax and property tax accounted for 9.50% %, customs duties and other taxes account for 2.00%." Therefore, the Danish tax system can really be called "robbing the rich and helping the poor".

However, Northern Europe is not as beautiful as we imagined with so many blond and blue-eyed handsome men and women. According to my younger brother who studied in Denmark, he rarely sees eye-catching GGMMs. The most beautiful ones are fairy-tale castles and villas. In addition, the Danish language is really hard to hear, the livestock industry is really developed, and vegetables are really hard to eat. For traditional Chinese people, it is delicious to eat a few meals of steak and lamb chops, but after eating dozens or hundreds of similar things without vegetables, I am afraid that I want to die.

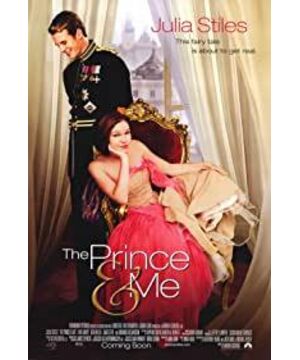

View more about The Prince and Me reviews