There are plots revealed...

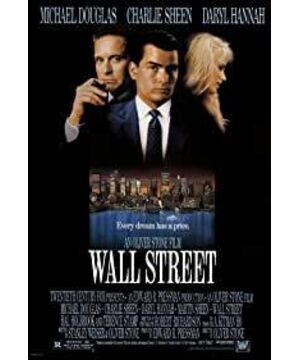

Greed is Good. This is The vernacular that has been espoused by the financial industry for decades. This 87-year-old film severely stripped off the false masks of Wall Street bankers and created a financial crocodile Gordon Gekko with the supreme money and the best interests, and it was the envy of women who love men for decades. Villain. Gekko represents a truth that never goes out of time in the investment market: "Knowing inside information is the way to make money." This truth is still tried and tested in the current Chinese capital market.

Bud Fox gained Gekko's appreciation by leaking the internal information of his father's company Bluestar (interruption: The aviation industry represented by Blue Star is an industry that has always been rejected by financiers, just as Gekko commented that the aviation industry has low profits. , The labor union is strong, and it relies too much on oil prices. Well-known companies such as Buffett have publicly commented that the aviation industry is the worst industry sector). In the subsequent trading operations, Bud has become a dual identity of private investigator + commercial spy. By tracking the itinerary of business leaders to speculate on its acquisition plan, Bud helped Gekko and himself make a fortune, and severely hit Gekko's opponents. Wildman.

When the hype involved the company Wildman acquired, Bud had no guilt. Until he tried to reorganize and expand Bluestar, Bud persuaded the union to absorb Gekko's investment, and designed some business development plans (this is similar to our team's daily work, but they do a lot of simple and clear T_T). When Bud finally succeeded in acquiring the company and preparing for a grand plan, he discovered that Gekko was going to liquidate and resell the company. Only then did he realize that he had worked so hard, and even broke with his father, and ended up making wedding dresses for others.

Bud began his revenge plan. This "PUMP AND DUMP" (deliberately guiding the market to push up the stock price, and then sell a large number of arbitrage, usually for small-cap stocks) is repeated in countless financial films. Of course, in order to conform to the trend of Hollywood climaxes, the financial crocodile Gekko also naturally fell in love with it, and even gave Bluestar to his old rival Wildman. At the end of the film, Bud recorded evidence of Gekko insider trading with a hidden tape recorder. Classics are classics after all, and this trick is still a signature method for collecting evidence in major crime dramas.

In fact, to be fair, Gekko's actions do not have much moral controversy today. Today's financial markets have matured enough to legalize moral hazard. IB's packaging and listing is nothing but a gorgeous version of divestment arbitrage, which is no different from Gekko's reselling of Bluestar to the bank, and it is even more harmful to the public. I believe that the comrades in the industry will know exactly what kind of companies are listed.

Recommend this article to analyze the various transaction cases that appeared in Wall Street and analyze whether there is a risk of illegality. http://crookedtimber.org/2003/07/21/wall-street/

Another copy of Gekko's famous golden words: Greed, for lack of a better word, is good. Greed is right. Greed works. Greed clarifies, cuts through, and captures, the essence of the evolutionary spirit. Greed, in all of its forms ; greed for life, for money, for love, knowledge, has marked the upward surge of mankind and greed, you mark my words, will not only save Teldar Paper, but that other malfunctioning corporation called the USA

Michael Douglasput a big villain Become a heartthrob, so Wall Street is greedy from the surface to the bones, and the bubble is snowballing, and the credit crisis is over, and the financial tsunami is over, and there is "Wall Street: Money Never Sleeps."

View more about Wall Street reviews