"The failure of Barings" has always been a classic case in finance classrooms.

"Genius trader" Nick Leeson makes some of the most common mistakes in speculation. If you can learn these lessons as a retail investor, you will be able to avoid losses in the stock market.

First, Nicklenson's team wore something different to stand out.

A maverick personality will work against the market.

Pretending to be handsome and cool will make you continue to challenge difficult tasks, and the danger will also increase. Don't stand in front of a running train just to prove yourself.

Second, Nicklenson did not close his position immediately after placing the wrong order.

Mistakes in placing an order in a hurry are common. Buying becomes short selling, the buying quantity is wrong, and the buying price is wrong.

Orders should be checked before trading. After an error is placed in the order, the position will be closed immediately, regardless of win or loss.

Third, all the transactions Nicklenson made in the future were to make up for the losses in the early stage, which would lead to the mentality of turning over the capital.

Maybe it will make you a lot of money at first, but sooner or later you will have to pay it back. Don't trade to make up for mistakes. The mentality of turning over the capital after a loss will lead to even greater losses.

Fourth, Nicklenson took a position against the market in order to win over Nikkei's largest client in the market, Bonifoy.

Don't trade to make money. Don't trade hard for bonuses. Positions are to be opened based on the direction of the market.

Fifth, Nicklenson drinks like crazy

Don't drink, smoke, eat junk food. Anesthetizing yourself loses the ability to think.

Finally, starting in the second half of 1994, he bought a large amount of Nikkei futures and shorted JGB, the Japanese government bond. This hedging strategy is so commonplace that Nicklenson is arguably not taking any risks. But he forgot the risk of black swans.

On January 18, 1995, the Kobe earthquake in Japan, and in the following days, Tokyo's Nikkei index fell sharply, while bond prices rose sharply. Nick did the complete opposite! ! ! (The government will lower interest rates after an earthquake to stabilize the economy. Bond prices will rise.)

The market will not always be calm, and there will always be surprises at critical moments.

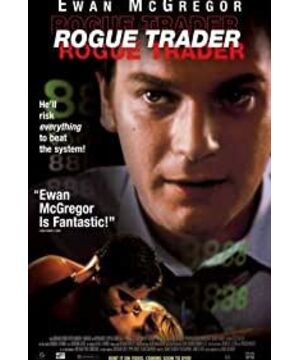

View more about Rogue Trader reviews