In the Inside job documentary, Matt Damon explained that the characters are all big names, involving senior American executives, top bankers, financial analysts, university professors, and even government officials from Singapore, China, and France. The scariest movie I have ever watched.

Too big to fail tells how from the collapse of Lehman Brothers to the 700 billion bailout plan, the financial team with the Bush Administration’s Treasury Secretary Paulson at the core made decisions and tried to save the financial crisis. William Hurt was nominated for an 11-year Golden Globe and Emmy Award for playing Paulson.

Take away: As long as it criticizes the work of the financial industry, it will definitely emphasize that the government has spent more than 800 billion US dollars in taxpayers' money to rescue these financial institutions. But in fact, the money is used to buy preferred stocks of these financial institutions. We can think of preferred stock as a kind of bond, with 8%~12% interest per year. After the worst year of the subprime mortgage crisis has passed, the rescued financial institutions have all repaid the money the government aided them. The government not only did not lose money, but made a lot for taxpayers.

Margin Call is a story alluding to Goldman Sachs's fire sale on the eve of the crash. "Financial engineers earn a hundred times more than engineers. Engineers build bridges. Financial engineers make dreams. When the dream turns into a nightmare, others pay for it."

Take away: Never be superstitious about VAR, even if there is no other choice, do not set the threshold too low (the next volatility and VAR predicted by the EGARCH model)

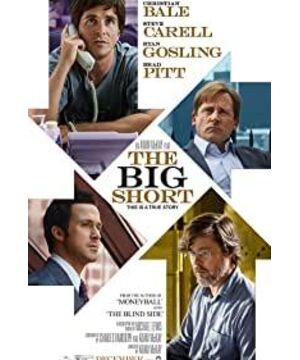

View more about The Big Short reviews