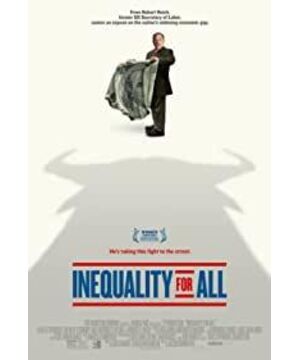

The protagonist of the documentary, a former labor secretary under Clinton, is also an economist.

It's about the wealth gap in America.

There is an interesting point at the beginning of the documentary, several celebrities guess the gap between the rich and the poor in the United States

Unexpectedly, the United States is still ranked behind Côte d'Ivoire and Cameroon

Sixty-fourth!

(I was a little surprised, much worse than I thought)

In 1978, the United States was already the world's largest economy.

The average male job pays $48,302

The top 1% earning a job salary of $393,282

From 1978 to 2007, the U.S. economy developed rapidly

GDP has grown from $2.35 trillion to $15 trillion, more than a sevenfold increase

In 2007, what did the average American earn at work?

Not rising but falling, only $33,751!

The income of the top 1% has reached $880,000, more than doubled

30 years of rapid economic development, ordinary people's wages have dropped by 25%

The accumulation of wealth is even more outrageous

The wealth of the 400 richest Americans is more than half of the bottom half of the Americans!

(mainly the growth rate of assets, real estate and stocks)

By the second quarter of 2021, the gap between the rich and the poor will further widen

The wealth of the richest 1% is 14 times that of the bottom 50%! !

Then began to look for the reasons, mainly these reasons

1. Diminishing Margin of Consumption

2. Manufacturing outflow

3. School is getting more expensive

4. The reduction of labor unions

5. Capital controls American democratic elections

6. Inequal taxation

1. What about the diminishing marginal consumption?

Refers to different income levels, the proportion of consumption expenditure to disposable income is also different

The richer the people, the lower the consumption ratio

For example, if a rich man earns 10 million a month, he buys a mobile phone to use, and he will buy at most seven or eight of the best Huawei mobile phones, which is only 70,000 to 80,000 yuan.

But what about ordinary people with a monthly income of 10,000 yuan, each of them will buy 4,000 yuan of mobile phones to use, and the consumption will be 4 million yuan

One consumes 70,000 or 80,000 yuan, and the other consumes 4 million yuan

Four million, how many people can support the mobile phone industry, if it drops to 70,000 or 80,000, how much will wages be reduced, and how many people will have to be laid off?

If the gap between the rich and the poor is too large, it will lead to insufficient consumer demand and insufficient consumer demand, and enterprises will reduce production, lay off employees and reduce wages

The most injured are the workers...

Today in China, because too many ordinary people are carrying mortgages, their consumption is tight, which has seriously damaged our country's economy...

People with spending power can still consume more and promote internal circulation. It is best to use domestic products. After all, every penny of domestic products will end up in the hands of domestic people.

The documentary tells the story of a rich man who only eats so much food, buys so many pants, and cuts his hair a few times a day.

2. Manufacturing outflow

Economic globalization, more and more U.S. manufacturing has moved overseas

A large number of manufacturing workers began to lose their jobs, even if they stayed in the United States, using automated machinery

Detroit, the former Motor City, is bankrupt

This involves the profit-seeking nature of capital, which is always chasing the best investment opportunities.

The United States is much higher than developing countries in terms of employees and production costs

These low-margin manufacturing industries have been transferred, and China has also become the world's largest manufacturing country.

Although the profit margin is low, it can provide a large number of employment

These employed people, with income, have spending power, which further increases market demand and forms a positive cycle

Amazon's annual sales are 70-80 billion US dollars, and the employment population is only 60,000

If it is manufacturing, it may be 60, 80, 1 million employed people

Average Job Income in the U.S.

Fast Food Chef, $21,000 per year

Cashier, $20,000 per year

Taxi driver, $25,000 per year

Comparing the 1970s to 2010, the average job

meat processing

In the 1970s, $40,000 per year

In 2010, $24,000 per year

Bank teller, 1970s, $28,000 per year

In 2010, $16,000 per year

at the same time

Compared to the 1970s, spending on rent and medical care has increased significantly, and disposable income has shrunk significantly.

Median male salary minus household expenses, down from $32,000 to $14,000

Quality of life for many Americans is declining

The education system has also undergone tremendous changes,

In the 1940s and 1970s, a large number of public schools were also built, and higher education became affordable

But after the 1980s, higher education became more and more expensive.

Students have to take out loans to go to school. In 2017, data showed that the number of students with student loans in the United States was as high as 44 million, accounting for about 25% of American adults.

Former US President Barack Obama paid off his student loans at 43

At present, the tuition fees of public universities in the United States are between 20,000 and 40,000 US dollars a year, including accommodation.

Housing and tuition at private schools are $40,000 to $60,000 a year

The top nine private universities with the most expensive tuition in the United States (statistical data includes out-of-state tuition, fees, and room and board)

In 2020, the median U.S. salary was $35,612

If you leave out the mortgage (rent), car loan, medical insurance, cost of living

I really can’t save much money in a year. Facing this high tuition fee, it is undoubtedly a huge pressure.

High tuition is best for the elite 1% rich families, and worst for ordinary people

Education is the best way out of poverty and into the middle class

The reduction and suppression of trade unions make it impossible for workers to protect their legitimate rights and interests

Money starts to control democracy

More money is spent on elections each year, from $1.5 billion in 1998

In 2010, it was already $3.5 billion

Spend money to find teams to help you win elections

The 2020 presidential election could cost nearly $14 billion, according to the US Political Giving Database

The money donated by the consortium is not donated in vain, it will be "repaid" in the future

The income of the rich is increasing, but the tax rate is getting lower and lower

The marginal tax rate is based on different income divisions. The higher the income, the higher the tax that needs to be paid.

Marginal tax rate dropped from a peak of 91% to 35%

Buffett's tax rate is only 17.7%, and his employees are paid an average of 32.9%

In the end, our former secretary of labor is back in school

Through education, call for equality of people~

But the reality is cruel. The equality of the United States is getting further and further, and the gap between the rich and the poor is further widening.

Welcome everyone to pay attention to my public number

Orange loves to watch documentaries

View more about Inequality for All reviews