On April 11, 2018, Shanlin Finance Zhou Boyun surrendered, Ponzi scheme 60 billion yuan

On December 26, 2017, Qianbao.com Zhang Xiaolei surrendered, Ponzi scheme 30 billion yuan

On December 10, 2008, Bernard Madoff was accused by his son of a Ponzi scheme of 50 billion U.S. dollars

There have been scams again and again, and the amount involved is staggering again and again. What's behind this time and time again?

At the end of the film, Madoff, with helplessness, hesitation, and even a little anger, asked dejectedly: Do you think I have anti-social personality? It seems that all of this has the possibility of being "understood"

Madoff in the film is cold, shrewd and muddled. From his perspective, he kept absorbing the money of innocent and greedy people by ruthlessness, by shrewdly dividing the business to prevent his family from seeing the slightest insight, and by being muddled to keep him in the scam for twenty years. Can't stop, although perhaps countless of the nights are dependent on sleeping pills. These are exactly what he emphasized. Even in the end, he was trying to make everything understandable or logically recognized, even though he didn't make any defense in court. He believes that his business is completely independent and has nothing to do with others; he believes that investors themselves are greedy and they are also responsible; he believes that he is just not so lucky, he just happened to be a catharsis of the market sentiment before the 2008 financial crisis Tool; he thinks he has done everything he "should do", he thinks his family is "ignorant" and innocent, and it is true; he thinks he has no anti-social personality, and he didn't want to cheat for money in the first place.

Perhaps it is impossible to fully understand Madoff’s psychology from movies and incident reports, but only from these, objectively and rationally, Madoff’s cognition is bound to be problematic, but it is not entirely wrong.

In fact, not only Bernard Madoff, but also Zhang Daofu and Zhou Daofu, so these incidents are by no means accidental. So what are the reasons behind these "inevitability"?

1. The financial market system and the corresponding supervision system are not perfect. It is obvious that a liar can spend so long in the Securities Regulatory Commission and can make trouble on the Nasdaq. Even the investigation is just a cutscene. It has to be said that the loopholes at the institutional level are too large, or the seemingly effective market may just be the illusion of being manipulated by behind-the-scenes players. Similarly, the immature P2P market with imperfect systems has created two scourges, damaging millions of families.

2. Trust in financial markets. The foundation of today's global currency is the credit system based on the national background, and the core of transactions in the financial market is based on trust, otherwise the transaction cannot be completed. Just like Madoff’s son took out a series of titles, a series of positions, and a series of contributions to question FBI investigators, behind this “series” is a strong trust, so people around them will not think that there is a problem, and investors will also Just be crazy about it. And this seemingly unbreakable trust may be just a phantom reflected by the bubble, but it is broken at once. Therefore, in the financial market, the mentality of following trends in human nature is often fatal. When buying stocks, don’t trust any experts or institutions. When buying a fund, don’t just follow the lead of the so-called star fund manager. There are many scams in the fund. Stay sensible, have your own judgment, and don't take chances.

3. "Investors are also greedy." Undoubtedly, this cognition of Madoff is a fact. If I remember correctly, Zhang Xiaolei also said almost exactly the same thing, but human greed is not the main reason for investors' losses. The greed of human nature has been discussed too much, as if it were an axiom. If there is no greed in human nature, there would not be so many people eager for money and money. If human nature is not greedy, it will not be possible to "achieve" Madoff's deception for at least twenty years. It’s true to learn how to invest and manage your wealth to maintain and increase the value of your wealth, but at the same time, you must learn to behave in a proper way and stay sober.

I won’t say much about the family. Every decision on the road to wealth in life is not only an investment choice, but also a decision that affects life, and even the key to the entire family. Investment is risky, and you need to be cautious when entering the market.

Finally, whether you have an anti-social personality or not is not important. What is important is that the sin in your soul has already turned against the entire society.

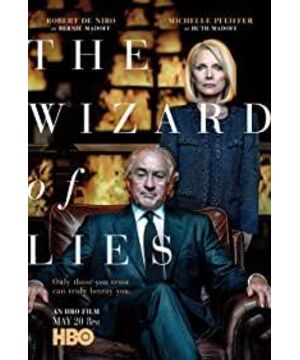

View more about The Wizard of Lies reviews