Enron, a giant company in the U.S. energy market 17 years ago, with a total revenue of $100 billion in 2000, ranked 7th among the "Fortune 500" selected by "Fortune" magazine , Has been voted as "America's Most Innovative" company for 6 consecutive years.

Arthur Andersen, the former "Big Five Accounting Firm", has a history of 100 years.

However, these profits made by relying on false financial reports and audits will eventually break.

Enron was established in 1985. In the short 15 years from 1985 to 2000, Enron's development was like riding on a rocket. In more than ten years, it has been on par with century-old stores such as General Motors, Exxon, Mobil, and Shell. During the 10 years from 1990 to 2000, Enron’s sales revenue rose from US$5.9 billion to US$100.8 billion, and its net profit rose from US$202 million to US$979 million. Stocks have become synonymous with it, and they have become numerous. The recommended target of securities ratings and the target of investors' pursuit, its stock price was as high as US$90.56 a year before bankruptcy, and its stock price reached US$94 a month before bankruptcy.

However, the financial report on October 16, 2001 showed that the company suffered a loss of 618 million U.S. dollars. Enron was targeted by the US Securities Regulatory Commission. The fraud incident was revealed. The stock price fell from 94 U.S. dollars to 2 cents in a month, and the market value dropped from its peak value. The US$80 billion fell to US$200 million, which means that countless investors lost their money. The employees of Enron were even more miserable. They were blinded by the company’s high stock price, and they did not hesitate to invest in pension funds. The result is even more predictable. , Tried a series of remedial measures and all failed, after announcing the failure of the acquisition with the Houston-based Dinoke Company. Enron had to declare bankruptcy. The assets listed on the bankruptcy list were worth as much as 49.8 billion U.S. dollars, making it the largest bankrupt company in the history of the United States.

Enron's series of fraudulent methods are extremely complicated, and it is said that even senior Wall Street analysts and accountants can't see the framework. In short, this is a pyramid structure. On the one hand, through the continuous separation of subsidiaries, the profits of the subsidiaries are used for blood transfusion to the top-level Enron company, and the liabilities of Enron are continuously passed on to the companies below. Smashed into pieces. Of course, this requires that each step must be calculated accurately, otherwise an error in one place will be exposed.

Of course, what should have come is here. In the constant fermentation of the incident, Enron's financial fraud has been continuously disclosed, and Arthur Andersen has been responsible for auditing and consulting Enron for a long time. It also publicly destroyed Enron's financial information, which was destroyed by trucks.

Wealth requires accumulation. It is too radical to obtain short-term benefits quickly, but it is tantamount to a conscious grave. Arthur Andersen did not maintain the independence requirements of certified public accountants and destroyed this century-old shop. , Disgraced reputation.

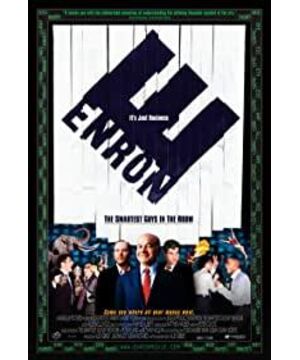

View more about Enron: The Smartest Guys in the Room reviews