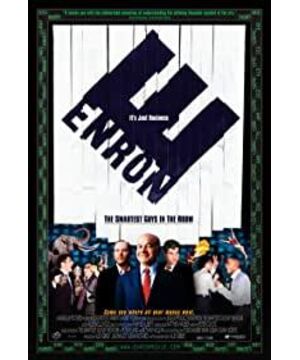

Enron, the 7th largest company in the United States, went bankrupt just a few weeks after its peak. More than 20,000 employees were unemployed. It shocked the country and became the most true portrayal of the dark side of the American dream. This incident developed the Sarbanes Oxley laws to prevent subsequent companies from repeating the same mistakes. After watching the brief introduction of the documentary film, I flashed an slogan from An Ran: Ask Why?

Looking at the whole article, I personally sorted out the following factors:

1. (The most important factor) The financial fraud is carried out by the principle of price accounting on the day, and the cash flow of the enterprise is not transparent for a certain period of time.

2. Leaders are over-focused on stock price rise, and constantly expand new business to make stock price overpriced

3. Enterprises control public resources related to people's livelihood, and Enron started with natural gas, and gradually extended its hands to major livelihood resources such as electricity, which made the people miserable (had been engaged in trans-California electricity trading, and earned income by shutting down electricity in a planned way. Price difference)

4. Politics and business collusion, the CEO, by virtue of his close relationship with Bush, paved the way for himself to control the people's livelihood resources. At the same time, Bush also gained a lot of income from Enron stocks.

5. Analysts are in the same league and even recommend Enron's stock simply and rudely without careful review. As for analysts who dared to question Enron, Enron frequently suppressed them.

6. Capital is for profit, and investment banks, even if they know that Enron is operating improperly, are driven by profit and choose to take risks.

It is these many factors that caused the Titanic to hit the rocks. Ironically, when the ship knew that the ship was about to sink, the captain did not coexist and die, but cleaned up and ran away early: The CEO was more than 4 months before Enron’s accident. I left my job in a hurry for personal and family reasons, leaving countless messes.

A few thoughts:

1. The ups and downs of enterprises are commonplace, and individuals must have their own foundation and protect themselves

2. It is very important to accept it when you see it well. Lu Bai, the "hidden CEO" of Enron's heyday, took the $200 million he received from the company early to become Colorado's second largest landlord, regardless of whether the subsequent period was turbulent or not, it did not affect him at all.

3. Enterprises must not control people's livelihood resources. Capital is greedy. If companies do not make money, they will go to extinction, so they will naturally fight price wars. If the prices of people's livelihood resources are controlled at will, the people will live in dire straits.

4. The financial industry needs more supervision.

5. You must have the ability to see (financial statements) clearly, which is essential for both job hunting and investment!

View more about Enron: The Smartest Guys in the Room reviews