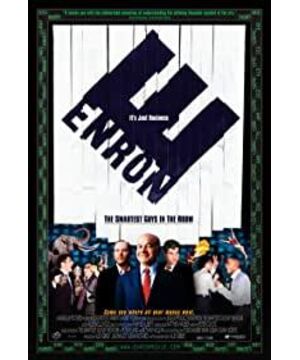

An Ran: The smartest person in the room

1. Do more and clear out:

Professional managers raise the stock price, and then cash out millions of yuan in allotments.

2. On the books, Enron's profit is very good, but in fact it is not that good.

Especially at that time, foreign companies were very cautious about entering the Indian market, but Enron still entered, but in the end all power plants in Daha were shut down!

3. Enron's stock price has been rising, but in fact it is no longer able to operate. Afterwards, Enroll launched Enroll Online Enroll Online Trading Market. (Because of targeting the potential of Internet stocks)

Enron created a futures market to buy and sell bandwidth for buying and selling broadband, but it did not make a profit in the end.

Climate options trading market? ? ? ? ---Refers to climate-derived commodities.

2. Climate Options

The origin of climate-derived commodities can be traced back to 1997. Due to the El Niño phenomenon caused by the greenhouse effect, the global temperature rises and the climate is abnormal, which in turn impacts the company's revenue. For example: global warming, rising temperatures, and people's extensive use of air-conditioning will of course increase the cost of enterprises, and will also lead to insufficient power supply from power companies at peak times. Then for certain specific industries, such as companies that make heaters and companies that make overcoats, they will all be affected by the greenhouse effect. At the beginning, climate-derived products were mostly tailor-made for general corporate needs, which may be traded in the store market by means of exchange (SWAP) or option; later, as climate-derived products began to be standardized, and in order to reduce the store market Trading credit risks. These climate-derived commodities have also begun to be traded in centralized markets. At present, the most common and largest trading volume should be temperature index futures and options, such as the daily low temperature launched by the Chicago Mercantile Exchange (CME) in 1999. Index (Heating Degree Day indices, HDD) and Daily High Temperature Index (Cooling Degree Day indices, CDD). The HDD and CDD indexes are accumulated by the daily temperature value (degree day), and the "daily temperature value" is calculated as: the difference between the "daily average temperature" and the "contract specified reference temperature". The daily average temperature is the average of the highest temperature and the lowest temperature of the day, and the standard reference temperature is the temperature stipulated in the contract. The reference temperature specified in the HDD/CDD index option contract launched by CME is 65 degrees (65°F) in Chinese style, which is about 18 degrees Celsius (18°C). This "base temperature" of 65°F is an estimate made by American meteorologists based on past temperature data. Currently, Taiwan also uses 18 degrees Celsius as the benchmark. Daily HDD represents the degree of daily average temperature lower than 18℃. It can also be thought of as how many degrees the average daily temperature has to rise to reach 18℃: The HDD index is the cumulative value of daily HDD: The same principle shows that daily CDD represents The number of degrees that the daily average temperature is higher than 18°C can also be thought of as how many degrees the average daily temperature has to drop to reach 18°C: CDD index is the cumulative value of daily CDD: Assuming that the “warm winter” will affect the average food Therefore, if you want to avoid risk in advance, Shanghao Food can buy an HDD put (the minimum change unit of HDD/CDD is 1 index), assuming that the simplified contract content is as follows: Performance price per unit value of royalties Total benefit limit HDD index 1,200HDD 800HDD 500HDD 300HDD 100HDD 1,000HDD NT$500 NT$50,000 NT$400,000 Remuneration (without royalties) NT$0 NT$100,000 NT$250,000 NT$350,000 NT$400,000* Remuneration (excluding royalties) NT$-50,000 NT$50,000 NT $200,000 NT$300,000 NT$350,000 *Because there is a limit on the total payment amount, it is not NT$450,000. When this winter is cold, there is a high probability that the HDD index will exceed 1,000HDD. At this time, although the deposit of NT$50 will be lost,

4. I think Enron just likes to do things and then comes up with new ideas. The stock market likes this kind of surprise news, and the stock price changes accordingly. The management ignores the warning message and keeps moving forward! The Emperor has no clothes.

Well deserved. Well deserved.

5. Andy Fastow---Enron's CFO, the culprit of the Enron incident.

Please the boss pleases his boss, so he conceals the fact that Enron is in debt of $30 billion. In order to keep the stock price from falling, it has been cheating. Shell companies were created and the liabilities were transferred to various shell companies. LJM Company is one of them. Fastow uses Enron's stock as collateral to obtain investment from many banks in LJM funds.

6. Enron is very generous to external consultants. In 2001, it paid Arthur Andersen a weekly audit fee of US$1 million. The law firm also took a lot.

7. Cook the books. Fake accounts

Merrill Lynch helped Enron make fraudulent accounts, turned loans into current assets, and purchased Enron energy cargo ships in order to eliminate the three cargo ships on Enron’s accounts, put them in Merrill Lynch’s warehouse, and buy them back 5 months later. .

Jeff Skilling Jeff Skilling

8. When he was about to go bankrupt, Jeff actually wanted to buy the company's special plane?? Oh, I don't know what to think.

Enron Energy Service Company EES has a loss of 500 million yuan.

Before the quarterly report was published, everyone thought that the target was not reached, and then when the report was about to be published, the target number was reached. --An Ran often has things. Set up a power station in California.

9. Is electricity still private? After Enron's trader turned off the electricity, the price of electricity went up, and then the trader was accounted for.

10. dead duck

Dead duck does not really refer to a dead duck, but refers to people or things that are worthless, things or plans that are destined to fail;'

A dead duck is completely finished (person or thing);

【story】

Dead duck originated in the 1920s and 1930s. At the beginning, it mainly refers to that certain figures in the political field have lost their original authority and influence, so they are worthless. Now it is extended to be worthless people or things and doomed to failure. Wait for the meaning; there is another saying derived from the old proverb (1829): Never waste powder on a dead duck-don't waste gunpowder on a dead duck, you can understand it yourself;

【usage】

Booth: You do that and I'm a dead duck;

Booth: If you do that, I'll be over (line from the American drama "Bone");

Jack is a dead duck because he failed the final exam;

Jack is dead because he failed the final exam;

The project is a dead duck since there is no money;

This project is doomed to fail because there is no money;

'

9. Energy Crisis

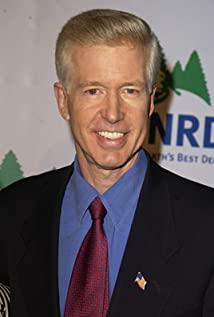

Let the governor of California take responsibility for the energy crisis, there is a financial deficit of 38 billion, and then Schwarzenegger replaced Davis at this time and became the governor of California.

10. mark to market profits were really losses.

11. you are on crack. Have you taken drugs?

12. Andy was the fall guy. As a scapegoat. He is the crook. History is always surprisingly similar! Isn't Ruixing the same? Take the CMO out as a scapegoat.

13. eerie

ADJ If you describe something as eerie , you mean that it seems strange and frightening, and makes you feel nervous.

example:

I walked down the eerie dark path.

I walked along the dark and scary path.

14. who was I? Who did I become? And realize that you may have seen your shadow.

View more about Enron: The Smartest Guys in the Room reviews