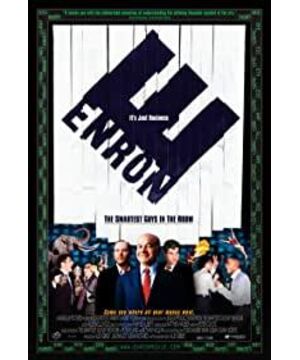

This is a company that was once rated as "the most innovative company in the United States" and was ranked seventh in the "Fortune 500" magazine. It used to have about 21,000 employees and was the world's largest electric power company. One of the natural gas and telecommunications companies once had an annual turnover of up to 101 billion U.S. dollars. But such a giant company collapsed in just a few years, causing the largest bankruptcy in the history of the United States.

The Enron incident has long been a case of MBA courses in major business schools today, and thousands of professors and CEOs from various countries conduct analysis and discussion every day. These smartest minds in the world have spared no effort to analyze the causes of the Enron incident from various angles, how to avoid the Enron incident, and summarize the enlightenment of the Enron incident to business operations.

From a later perspective, energy derivatives trading and HFV accounting standards are the Pandora's Box of Enron's bankruptcy. The newly appointed CEO Jeffrey Stringing is ambitious. He focuses on rapid expansion, loves adventure, and pays attention to soaring stock prices. Energy derivatives trading will futures the spot market, while HFV accounting standards treat Enron’s expected future earnings as current earnings and calculate them in the balance sheet. This provides Enron with extremely good-looking financial statements.

A terrifying conspiracy of the century, a painful business lesson, the last straw to overwhelm the camel!

In this Internet age that pursues radical expansion and adventurous and enterprising strategies, the Enron incident has sounded the alarm for countless business operators. It warns entrepreneurs: risks are everywhere.

Recording the biggest business scandal in Wall Street history, and revealing how a group of extremely smart senior managers linked up the seventh largest company in the United States, easily swept away billions of dollars, made investors lose their money and lost jobs to tens of thousands of employees. .

This film is based on the best-selling book "The Smartest Guys in the Room" from the Enron incident. It is produced using interview footage, audio recordings, and internal corporate data, and even reveals the inside story of the Bush family's possible involvement in the case. The Enron case has had a huge impact. It not only caused Arthur Andersen LLP, one of the world’s top five accounting firms, to be revoked by the U.S. Securities and Exchange Commission, but also seriously injured the internationally renowned McKinsey consulting firm within five years. It also made all business schools change their minds. In addition to clamoring for the supremacy of profit, the MBA students were taught "ethics and morality" again.

Major companies around the world have also taken "corporate governance" to the sky, hoping to win back the trust of investors. However, the Enron storm has not yet closed the case, and the climax may hit Wall Street again.

The inducement of the Enron incident is uncontrollable financial derivative risks. The essence is the illegal operation of listed companies. The Basic Law is the disclosure of false information. Helping the abuser is the coordinated cheating of intermediary agencies.

Greed and arrogance, arrogance and blindness, deceit and vanity. When the wheels of capital are rolling forward, they often carry these uninvited guests.

The first Feiguan application, the mini program has the same name: https://www.fillgreat.com/tools/app_download.html

View more about Enron: The Smartest Guys in the Room reviews