The story is only half told. Mark Baum, the hedge fund manager of Yuta, played by Steve Carell, finally reluctantly called on the mansion terrace facing the East River in New York to tell his subordinates that it was time to sell the creditor’s rights to the gambling transaction with Morgan Stanley. Forget the reminder or threat of the handsome shirt with a round inch head: "If you don't sell it anymore, what should I do if it falls?" Yes, the person who gambled with you is gone bankrupt, can you still get his money?

The reason why not many Wall Street giants have closed down, the three short-headed black swans in this film, or the reason why the bald eagle masters can still withdraw money from their dealers, I think we have to thank those in the fringe regions of the global financial system. The new rich fool took the Wall Street offer. In the film, S&P and Moody's credit rating companies refused to downgrade the junk CDO, etc., and Bear Stearns' stock price fell by half. His representatives were still in the debate and said they would continue to buy. At the same time as their own stocks, from Dubai to Singapore, from Hong Kong to Taipei, from Seoul to Tokyo, and from other Asian cities investment bank traders have successively received Wall Street up fronts wanting to sell super premium financial products. information. Everything is described as beautiful as Wall Street itself: you bet against him, his CDO breached your contract and you paid him the insurance, and he didn't have any problems and you took the premium. Can something go wrong with Shangguo Jinxian? Can there be a problem with Grand Master? These children in Asia just feel flattered: such a good thing is willing to sell us! Sure enough, burning incense for many years is useful, and it's time for Asians to be in their early days.

This film has made multiple levels of exposure or exposing to the practitioners of American financial and credit, but it lacks the presence of overseas investment. From the Cowboy college who specializes in the business of showgirls, to the securities and supervisory officials who go to Las Vegas on vacation at his own expense to hook up with Goldman Sachs, from the S&P reviewer who wears beauty goggles and doesn't look at anything all the time, to the office Colleagues outside are crying. The black female manager of Moroccan who has deep confidence in the company: It's hard to tell which of them is the real bad guy. Each of these Americans is a selfish idiot who makes money by making money from petty evildoers. You can scold them a hundred times and a thousand times for being a fool, but they can still put on a hundred and a thousand innocent faces. Go and claim any Hannah Elan-style accusations.

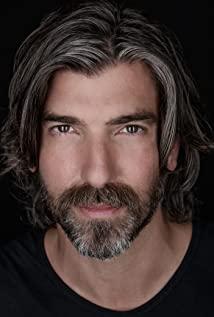

Oh, wait, there is also an extremely disgusting guy in the film who seems to be able to get promoted from a fool to a bad guy. It is the handsome South China guy (played by Byron Mann, the nationality of the character in the film is unknown) who laughed at a top restaurant in Vegas and talked about the boss of an asset management company that represents the interests of investors in name. Despite this, he did not commit any serious crimes. After all, this film did not reveal any perfidy or fraud that he had committed [knowingly and intentionally buying junk goods and causing investors to lose money]. To put it simply, the movie still leaves a door open for this representative of Asia: "I also believe in Goldman Sachs, I believe in S&P, didn’t you believe it then?" I can’t help but say: When this Blyde? Peter participated in the production of the film, in accordance with the Hollywood formula to highlight the "maverick hero, intelligent eye and unique genius" and for theatrical effect to belittle their American colleagues into mediocre foolish bastards, at the same time it truly has such a The evil of Ju's eyes slipped away from the court in the audience's hearts.

I can’t help but say one more thing: It’s unlucky enough for Asians to pick up Wall Street’s stupidly in reality, and now they have to act as the only scapegoat for the evil side of the financial turmoil in the movie according to American Fu Manchu’s imagination. It's too miserable. Where we are broken, we are really fools at the mercy of others. From Dubai to Singapore, from Hong Kong to Taipei, from Seoul to Tokyo, how many investment banks have fought against Wall Street forwards in fraud cases in the past six or seven years, how many cases have been settled, and how many million dollars have been returned, How much attorney fees have been paid, that’s all for the rest. When the storm came that year, no one dared not pay for compensation for fire fighting. The film didn't tell us: it was the money that eventually filled the pockets of heroes and geniuses in the film.

View more about The Big Short reviews