Because the routine is here, so is the human nature.

Look at Lee Gates, who is the financial host in the film. When recommending investment to ordinary people, he still runs the train like the bricks in China. Some people may ask, those expert moderators seem to be very analytical and powerful, can they make money?

Of course they can make money-it's just that they don't invest the money they make according to their own analysis, but they fool you to invest and make money.

That's the case with Lee Gates. He will tell you that this stock is good, stable and profitable, and all kinds of cool data analysis will make you stunned. Those viewers who do not have the ability to analyze and judge independently will easily pay the bill.

Especially if such a host uses another emotional weapon:

Do you want to live in a rental house for the rest of your life?

Your girlfriend is pregnant, is your milk powder money ready?

What? Do you want to make money by going to work? Please just your salary.

You don't want to be this way, right? I tell you, what you have now before your eyes is an opportunity to make a lot of money. Are you still waiting? Opportunity does not wait for you.

It is enough for him to make money just by watching his show. Besides, I don’t know if the host will charge the "advertising fee" from the company.

The reason that triggered the holding of guns to the TV station to hijack the host was that the stock price plummeted. The reason for the plunge was basically the same as that of domestic Internet finance companies' default and bankruptcy in the past two years-construction of capital pools, misappropriation of funds to fill other projects, project failures, capital breaks, and bankruptcies in default.

You see, the routines are the same.

Enterprises are of course guilty, because they are operating in violation of regulations. But is the host guilty?

It stands to reason that the host is not guilty, because the host is only used as a media to explain and recommend to you. Do you like to listen to it? As for the investment decision you make, it is naturally your own business, and it is not half of my business. Dime relationship.

Of course, the host in the film still expressed the meaning of "revenue earning" in the program. Now the industry does not allow to say "guaranteed income" such as "guaranteed", "interest-guaranteed" and other words, and the interest rate can only be said to be " Expected rate of return".

Of course the audience doesn't care about you. Anyway, I heard from you that you can buy it. I bought it, and I lost it, so I will look for you. Look at the investors of Pan Asia before, besieging Song Hongbing in a lecture. This is the logic-you said Pan Asia is good, I heard you say, now my money is gone, you are a liar.

Sometimes ordinary investors are so blind that they are so blind that they cannot even be called investors.

I didn’t understand the analysis at all, just looked at the rate of return, had no concept of risk, and blindly followed the “experts”... I made money and felt that I was awesome; if I lost money, it was naturally the fault of others, just because I listened. his.

Can this be called investment?

The result of the vigorous live broadcast of the incident: the financier was lightly punished, and the investor was killed.

A helpless tragedy.

As for other viewers watching the live broadcast?

There is a very interesting scene at the end. The young man who turned his head to watch the live broadcast, after the live broadcast, turned his head to continue playing table football, as if nothing happened.

For others, this is nothing to do, just watching a lively event.

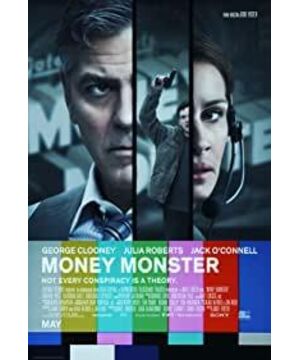

View more about Money Monster reviews