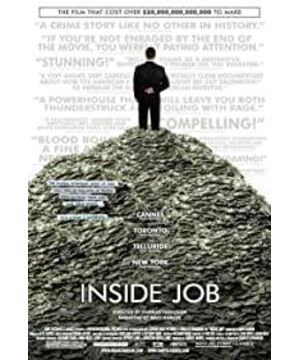

I have always found economics to be very interesting. The 2008 financial crisis is a particularly typical example, and I have always wanted to understand it. Finally finished watching this documentary, let me share my understanding. It is the investment bank that transfers the CDO to the insurance company, and then pays the rating agency to give all the 3A grades given by these CDOs, so that many customers can invest, because for them, 3A means that it is an investment that is guaranteed to make money without losing money. These are all subprime mortgages, all mortgages and car loans from people who have no jobs or unstable jobs, and then it seems that everyone has money and house prices have risen. People who take out loans to buy houses are not worried at all because they think they can buy a house. Not only will they make a portion of the loan without making up the loan, this has formed such a false bubble, and the academics are also collecting money to do things, and write false and deceptive reports to confuse everyone, and the regulators have not given any interest in derivatives. The industry imposes restrictions because many of them are the beneficiaries. In the end, Lehman Brothers, AIG, and many other companies went bankrupt, but the high-level executives of these companies did not go bankrupt, and they walked away with a lot of money, and it was the common people who really suffered. During this period, I went through the Clinton and Bush administrations. When Obama came to power in 2008, he said that he wanted to increase supervision and change the face of Wall Street. In the end, he appointed the former group of people as Treasury Secretary and Economic Advisor, just for the election campaign. Just shouting slogans, after all, this is the government of Wall Street. As said at the end, the disaster is finally over, but the people and institutions that caused it are still in power. But at least there is something worth fighting for.

As an outsider, I feel that the specific relationship and operation principle of tapes, investment banks, CDOs, and CDSs are not particularly clear, but after reading it, I still feel a little bit, so I wrote it down according to my own understanding.

——————————————————

Replenish:

An individual borrowing money from a bank to buy a house will keep a mortgage and repay a portion of the principal and interest every month. If it is not repaid, the house will be owned by the person who owns the mortgage. Financial institutions buy thousands of individual mortgages, tie them together, and sell stocks in this pool to investors. This stock is more profitable than buying Treasury bonds. Housing prices are rising. Investors think they sell at worst. The house will not lose money. The house is rising. Investors are getting more and more greedy. They want to buy more securities. Lenders have to buy more mortgages. Banks lower interest rates. The CDO rating agency still gives AAA. As investors and banks keep pouring money into the real estate market, house prices continue to rise. Slowly, some people can’t afford to start defaulting. There are more and more idle houses in the market. Investors are also starting to go bankrupt

Disregarding risks for the benefit

"The fault is not in fate but in us"

View more about Inside Job reviews