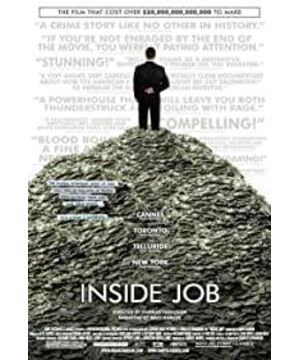

I finally picked it up again after I watched it halfway and gave up countless times. With some supplementary background knowledge, I finally learned a lot from this documentary, mark it.

1. The first level of superficial cognition about the 2008 financial crisis:

home buyers->lenders->investment banks->investors

In a normal market, people choose a suitable house on the premise of being able to repay, pay a down payment of 30% to 80%, and borrow the remaining money from institutions. According to the negotiated interest rate, it is divided into a cycle of 20-30 years. Pay back the money to lenders/lenders. The lenders wanted to collect the money in advance, so they sold the loan to ib. ib packaged the loans they had into different CDOs and issued them. As long as they didn't look too bad, the rating agencies would give them a "A". If the medicine is salvageable, there is no other way but to give b and c. But in fact, the last 95% of the CDOs are finally rated A or above.

It is very clear in the film, because CDO itself can bring a higher rate of return than the mortgage interest rate + a premium of 3a, IB is very happy to sell CDO to make money, and lender can immediately sell the loan that has just been released. Don't care about solvency, so the result is that a lot of loans are needed to build CDOs, and the standards are getting lower and lower, and both cats and dogs can buy a house with a 5% down payment. Housing prices are getting higher and higher, residents' debt is getting higher and higher, and the bubble is slowly rising. When house prices rise, of course, it is thriving. After all, buying a house is equal to picking up money, and you have to pay off the mortgage when you break the pot and sell iron. But when the standards are getting lower and lower, and even applying for a loan in the name of a dog can be approved in seconds, the default rate quietly rises, and it is about to reach a turning point that can cause housing prices to fall.

Housing prices have fallen, the default rate has snowballed, no one has repaid, CDOs have become a pile of waste paper, and the various pension funds that bought CDOs want to cry without tears.

2. Some details behind the simple logic of the second layer:

There is a sentence in the film that probably says that before each crisis comes, the complexity of financial products and the proportion of fraud are always high. From the point of view of fraud, the case of the Mexican couple who do not speak English in the film is not very typical when they encounter a loan shark lender. In the big short, the real estate agent said that it does not matter if the borrower has no income, anyway, they can After the review, it can be sold to an investment bank anyway. This case is, to a certain extent, a more typical lack of risk control, which induces the society to take advantage of loopholes.

However, the documentary does not seem to involve the rise of interest rates. Perhaps the rise in interest rates is more like an exogenous variable than a pot, so the documentary does not mention it. In short, if the rising interest rate is not the decisive cause of the avalanche, it is a very heavy straw. The broker in the big short said make 2k on a fix-rate prime, but can make 10k on a subprime adjustable. If you think about it like this, you are a broker and you also persuade customers to borrow floating interest rates, but the mark in the big short said to the stripper that if home prices isn't go up, you're unable to make refinance, monthly payment would increase even double. These Risk disclosure is clearly not popular with lenders. Regarding the rise in interest rates, the original intention may be to curb the overheating of the economy, but the explosion was unexpectedly accelerated. It's a bit like pouring a glass of water into a frying pan when it catches fire. The key is that the big guys at the top didn't understand the real situation at the bottom.

I found a description of how the money lender has fallen, but the point of confuse is that fanny and freddie have fallen too...

Fannie Mae and Freddie Mac , which previously accounted for 70 percent of the U.S. subprime loan market , are dominated by government agencies that package loans into securities that promise investors the principal and interest rates. As the scandals between the two companies broke and the government restricted their business growth, the entire subprime market began to scramble for the loans they bought. Throughout the process, new market participants, in pursuit of profit, have overly pursued high-risk loans. When Fannie Mae and Freddie Mac dominated the home loan market, they often set clear lending criteria that strictly dictated what types of loans could be made. Today, due to the involvement of thousands of high-risk hedge funds , pension funds and other fund investors around the world , the original lending standards have become a dead letter in the face of high interest rates, new market participants and Wall Street dealers . Lenders are constantly encouraged to experiment with different loan types. Many lenders don't even require subprime borrowers to provide proof of financial qualifications, including tax forms, and lenders rely more on mechanical computer programs than on appraisers' conclusions when making home value appraisals. Potential risks buried deep in the subprime loan market.

--------The following is to be sorted out-------

3. On the third floor, advanced cds finally appeared:

Crazy notes are as follows:

- investment banks borrowing heavily to buy more loans and create more cdos. when they running out loans, they were filling the bonds with risker mortages (subprime bonds)

AIG were selling huge amount of credit default swaps.

for investors who owns cds, cds worked like an insurance policy. an investor who purchase a cds, paid AIG a quarterly premium, if the cdos went bad, AIG promised to pay the investors for their losses.

But unlike regular insurances, speculators could also buy cdss from AIG, in order to bet against cdos they didn't own. Since the des were unregulated, AIG didn't have to put aside any money to cover potential losses. Instead, AIG paid its employees huge cash bonus, as soon as contract was signed. but if the cdos later went bad, AIG would be on the hook. (General insurance is based on a slightly higher premium than compensation*probability of accident, something like In catastrophe insurance, why not prepare to accrue losses...)

AIG financial product division in london issued $50b worth of cdss during the bubble, many of them for cdos backed by subprime mortgages.

The fourth layer, cds plus leverage:

by late 2006, gs not only sell these toxic cdos, it started betting against them at the same time it was telling custormers that they were high-quality investments. by purchasing cds from aig, goldman could bet against cdos it didn't own and get paid when the cdos failed.

goldman brought at least $22b cds from aig, it was so large that goldman itself realized that aig might go bankrupt, so they spend $150m insuring themselves against aig's potential collapse.

then in 2007, gs went even furthur, they start to sell cdos that was specifiedly designed so that the more money their customers lost, the more money gs made. (boy, that timberwolf was one shitty deal. However Goldman sold a total of 600m usd Timberwolf)

blankfein in the context of market making, it's ok to sell some shit to investors.

hedge fund manager john paulson made $12b bet against the mortgage market, when he ran out of mortgage securities to bet against, he worked with gs and db to create more of them.

(bruce miller & mark baum)

morgan stanley was also selling mortgage securities it was betting against, being sued by pension funds.

"I'm betting on my investment to lose it all to get insurance coverage"

they tend to sell options very cheap when market think it won't happen.

----Advanced CDO

cdo square

Synthetic cdos: cdo made up of cdos, bet from sidebars. The total pool is about 20 times the book value, 50m can leverage 1 billion funds

Layer 5, crash:

The last carnival: the housing default rate has risen sharply, the CDO price remains unchanged, the big shorts are anxiously waiting, and the margin call is busy rolling CDOS

In March 2008, Bearsterm had an accident, and Lehman did not collapse until September, and then the global financial crisis.

By 2008, home foreclosures were skyrocketting and the securitization food chain imploded. lenders could no longer sell their loans to the ibs, a dn as the loans went bad, dozens of lenders failed.

aig bail out, the bail out legislation does nothing to stop the tide of layoffs and foreclosures.

Lehman collapsed, monetary market collapsed, commercial paper market collapsed, in which many companies relied on to pay their operational fees, such as payroll.

the hedge funds who had had assets with lehman in london discovered overnight, to their complete horror, they couldn't get those assets back.

as the end of the day, the poorest always pays the most.

How the recession came about: trust / lehman hub broken / can't stop foreclosures

Tier 6, buy order:

AIG bailed out, gs were paid $62b the next day.

700 billion bill passed, final cost taxpayers over $150b, $14b to gs.

henry paulson/ ben bernanke

geithner/tricadia/lurry summers

Layer 7, accountability:

Academia <-> Industry <-> Government

lobby to relax limits on leverage

none of these securities got issued without the seal of approval of the rating agencies.

solors: deregulation had tremendous financial and intellectual support, because people argue it for their own benefit. the economics profession was the main source of that illusion.

lecg/analysis group, that provides academic experts for hire. pms aquitted.

prudential in academia, academic conflicts of interest

mishkin is easier to catch academics than industry

Layer 8, reflection:

imf chief economist RAGHURAM RAJAN

more profits with more risks. raj's paper focused on incentive structures that generated huge cash bonus based on short-term profits, but which impose no penalties for longer losses. what you need do is to compensate for risk-adjustment performances.

allen sloan oct-2007 fortune

Tier 9, the ultimate answer:

without a good system, doomed???

kind of evolution

Bush administration, intensifying the gap between the rich and the poor and encouraging people to borrow money to buy houses, long-term and short-term benefits? What to take back?

Keynes vs Hayek xxxxxxx

View more about Inside Job reviews