The financial industry situation in 2001:

By the time George W.Bush took office in 2001,financial sectors were vastly more concentrated profitable than ever before.Dominating this industry were five investment banks-Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch and Bear Stearns,two financial conglomerates- Citigroup and JPMorgan, three security insurance companies-AIG, MBIA and AMBAC, and three rating agency-Moody's, Standard&Poor's and Fitch. Linking them all together was the securitization food chain. A new system which connected trillions of dollars with investors all over the world .

About CDO Secured Debt Certificates:

In the old system, when a homeowner paid their mortgage every month to their local lender. And since the mortgages took decades to repay, lenders were careful. In the new system, lenders sold mortgages to investment banks. The bank combined thousands of mortgages and loans—including car loans, student loans, and credit card debt to create a complex derivative-collateralized debt obligations—CDO. The investment banks then sold the CDOs to investors. Now when homeowners paid their mortgages, they paid to the investors all over the world. The investment banks paid rating agencies to evaluate the CDOs. This system was a ticking time bomb. Lenders did not care anymore about whether a borrower could repay. They started to make riskier loans. The investment banks did not care either. The more CDOs they sold, the higher their profits. And the rating agencies,which were paid by the investment banks of CDOs, have no liability if the CDOs were proved wrong.

About CDS credit default swaps:

AIG created credit default swap. For investors who own CDOs, it is like an insurance policy. An investor who purchased CDS pays AIG a quarterly premium. If CDO went bad, AIG promises to pay for their losses. But unlike regular insurance, speculators could also buy credit default swaps from AIG-in order to invest in CDOs they did not own. Since the CDS is not regulated, AIG did not have to put any money to cover potential losses. Instead after the contracts are signed, AIG paid their employees huge cash bonuses.

About corporate governance:

I hold the board accountable when a business fails. They are responsible for hiring and firing the CEO-big strategic decisions. The problems with boards in America is the way boards are elected. The boards are pretty much picked by the CEO. The board of directors and compensation committee are the two sectors to determine pay for executives.

My own summary of how Wall Street works:

Goldman Sachs creates and sells the junk CDOs which are wrongly rated as AAA to the investors then buys the CDS from the AIG to gain when the CDO fails. The rating agency earns a lot from Goldman Sachs by issuing fake rating reports which are protected by constituition saying “based on opinons”. Please give applause to Wall Street for earning money from the stupid. This is how they make money.

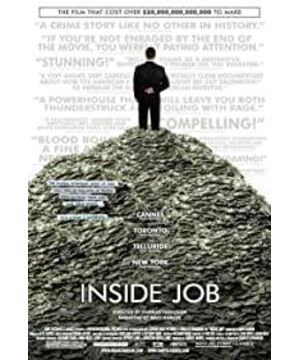

View more about Inside Job reviews