-

Beth 2022-12-17 01:22:58

language film plot

Too big to fail this movie? It is said that the subprime mortgage crisis in 2008, the protagonist is the US Secretary of the Treasury, Paulson. Summarize the main plot. The American people used to take out mortgage loans normally. Later, some banks were able to package the mortgage into CDO, and...

-

Emmalee 2022-12-18 19:31:41

Everyone wants to be too big to fail

Too big to fail, a more appropriate translation should indeed be "too big to fail". Businesses all over the world do not want to be too big to fail. When a crisis occurs, the government or other institutions can pay for their greed and blindness. Tang Wanxin's Delong, who used to dance wildly, had...

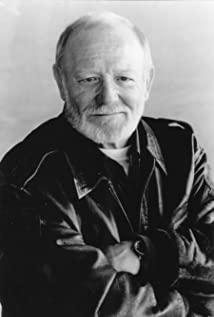

James Woods

Related articles

-

Michele Davis: I hate to do this right now, but I'm going to have to have a press call first thing, and I don't know what I'm going to tell them.

Jim Wilkinson: Okay, here's how you explain it. Wall Street started bundling home loans together - mortgage-backed securities - and selling slices of those bundles to investors, and they were making big money. So they started pushing the lenders saying, come on, we need more loans.

Henry Paulson: The lenders had already given loans to borrowers with good credit, so they go bottom feeding, they lower their criteria.

Neel Kashkari: Before, you needed a credit score of 620 and a down payment of 20%; now they'll settle for 500, no money down.

Jim Wilkinson: And the buyer, the regular guy on the street assumes that the experts know what they're doing. He's saying to himself, if the bank's willing to loan me money, I must be able to afford it. So he reaches for the American Dream, he buys that house.

Neel Kashkari: The banks knew securities based on shitbag mortgages were risky...

Henry Paulson: - you'll work on 'shitbag'...

Neel Kashkari: - so to control their downside, the banks started buying a kind of insurance. If mortgages default, insurance company pays. Default swap. The banks insure their potential losses to move the risk off their books, so they can invest more, make more money.

Henry Paulson: And while a lot of companies insured their stuff, one was dumb enough to take on an almost unbelievable amount of risk.

Michele Davis: AIG.

Jim Wilkinson: And you'll work on 'dumb.'

Michele Davis: And when they ask me why they did that?

Jim Wilkinson: Fees!

Neel Kashkari: Hundreds of millions in fees.

Henry Paulson: AIG figures the housing market would just keep going up. But then the unexpected happens.

Jim Wilkinson: Housing prices go down.

Neel Kashkari: Poor bastard who bought his dream house? The teaser rate on his mortgage runs out, his payments go up, he defaults.

Henry Paulson: Mortgage-backed securities tank. AIG has to pay off the swaps. All of them. All over the world. At the same time.

Neel Kashkari: AIG can't pay. AIG goes under. Every bank they insure books massive losses on the same day. And then they all go under. It all comes down.

Michele Davis: [horrified] The *whole* financial system? And what do I say when they ask me why it wasn't regulated?

Henry Paulson: No one wanted to. We were making too much money.

-

Richard Fuld: [on the housing crisis] You know, people act like we're crack dealers. Nobody put a gun to anybody's head and said, "Hey, nimrod, buy a house you can't afford, and you know what? While you're at it, put a line of credit on that baby and buy yourself a boat."

Joe Gregory: [chuckles] You heard anything from Buffett?

Erin Callan: He's asking for preferred shares at 40, with a dividend of nine percent.

Richard Fuld: [annoyed] We were just at 66. What the fuck?

Joe Gregory: Maybe it's just an opening gambit, Dick.

Richard Fuld: Sounds more like a goddamn insult!

Erin Callan: Dick, we're at 36 right now. We haven't been anywhere near 66 in months. The markets like Buffett. His name will push the price up overnight.

Richard Fuld: You know, I don't care who he is. I am not spending $360 million a year for the pleasure of doing business with him. Real estate will come back.

Joe Gregory: Koreans have been sniffing around.

Richard Fuld: There you go. And they won't steal us blind. I've seen this before: CEOs panic and they sell out cheap. Right now, the Street's running around with its hair on fire, but the storm always passes. We stand strong, and on the other side, we'll eat Goldman's lunch.

Erin Callan: So what do we do about Buffett?

Richard Fuld: Screw Warren Buffett.